You guys,

I thought it wouldn’t work.

You probably thought it wouldn’t work.

But Digit came through for me, so I wanted to share a quick update today letting your know how much I’ve saved using Digit, what I’m going to use it for, and give you another opportunity to bypass the waiting list for this awesome service to get Digit for yourself!

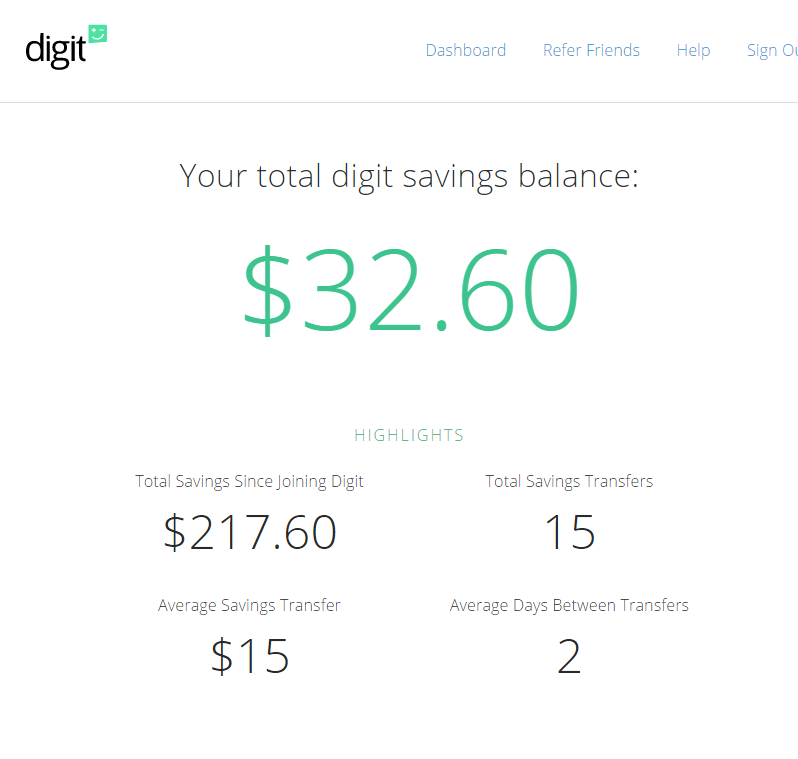

So, since I joined Digit on Feburuary 5th, 2015 (essentially 1.5 months ago), Digit has painlessly saved for me:

Drumroll, please……

What’s more, I have to say, their “algorithm” that sneaks money out of your account when you’re least likely to notice it really works! Of course, I saw the small transactions coming out of my bank account since I monitor it like a hawk, but I didn’t realize how much it was!

In case you missed the first post, or aren’t convinced yet that saving that much money is amazing, here’s a recap of Digit and why you need it:

What is Digit?

Digit links to your checking account and saves your money in the smartest way possible: by doing it for you, and in amounts that you won’t even notice. All you have to do is link your checking account, and then Digit analyzes your spending to determine what amounts it can transfer to your (free) Digit savings account without you even noticing!

That’s literally all you have to do.

It so simple, it too me less than 2 minutes to set mine up, and of course, it’s free!

Digit is simple:

I love me some budgets, tracking my net worth and all of that, but it’s nice to do something super simple that makes me feel good every time I log in! Once you’ve set up your Digit account, every time you go to login there will be one screen displaying how much you’ve saved – so you can feel good about your savings!

The whole system is set up around text messaging, so you can text a variety of commands to Digit, and Digit will replay with either an answer to your question, or completing the transfer you requested.

What is the downside?

- Savings earn 0%: That’s how Digit makes their money – they get to keep the interest. You can, however, transfer your money out at any time, to an interest-bearing savings account.

- Transfers take 1 business day: You can transfer your money out at any time, but it does take 1 business day. Really, that’s pretty fast, considering with most banks transfers take between 3 & 5 business days.

- Most of the function is text massage based: which means that if you don’t have text messaging, or don’t like it, you won’t be able to do much beyond linking your account, editing your account details, and pausing savings.

- Not all banks are available: many smaller banks and credit unions are not available yet, but Digit is constantly making more and more banks available.

How to sign up:

- Visit Digit and sign up. Be sure to use the links on this page (don’t just google it) or you’ll be waitlisted.

- Enter your mobile phone number & Digit will send you a confirmation code

- Once you confirm, you’ll get a “Hi & Nice to meet you” text from Digit

- You’ll connect your bank account by logging into online banking

- The, confirm your account and routing number

You’re all set up! Digit will begin analyzing your account and you’ll see your first savings transfer in 2-3 days!

Get Digit today through one of the links on this page and you won’t have to wait – you’ll have instant acccess!

*This post may contain affiliate links

Thanks for sharing! Definitely something I am going to be looking into :)

This sounds like a great app for people who aren’t big budgeters or think they don’t have the time to track their expenses/savings. I’m definitely going to direct some of my friends to this post so they can check it out for themselves!

Even if you’re really into tracking your budget, it would be interesting to see if their algorithm can find even more savings. Do you find that it’s discovering more than usual for you, or is it on par with what you would normally sock away?

This sounds like it would be helpful to my husband and I. We may have to give it a try. I will check iy out some more.