By now, I think you know just how much I love saving money.

I would almost go as far as to say that I’m obsessed with it.

But I wasn’t always that way. There was a time – when I was really, really, unhappy with my life – that I turned to shopping as a tool to help me feel better. Thankfully, we discovered (surprise!) that we were pregnant with out daughter, and the panic set the hubs and I into a money-saving frenzy, which then led us to turn around our spendy ways and feel better about saving money than spending it.

As a result, we’ve developed an arsenal of favorite tools that we use to save money.

And Digit.co is essential to that toolkit.

I introduced you to Digit.co in February of 2015, and I’m happy to report that it’s still going strong, saving us tons of money. Sometimes, when I’m introduced to a new tool that I love, I’m also afraid that it will be short-lived, almost too good to be true.

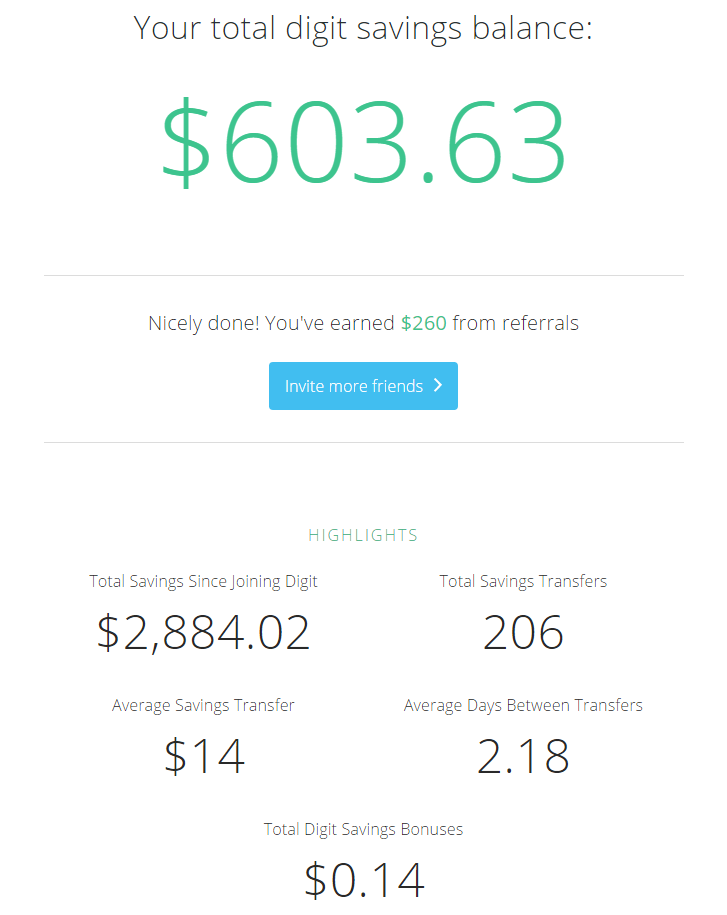

18 months later, Digit.co has found us $2,884.02

It’s pretty amazing, really!

We’ve been able to use that “found money” to pay off extra debt, pad our retirement, and even pay for a little mini vacation!

If you haven’t signed up yet but are interested in this free service, you can check them out at their website: Digit.co

Or, if you would like more information, check out this info:

What is Digit?

Digit links to your checking account and saves your money in the smartest way possible: by doing it for you, and in amounts that you won’t even notice. All you have to do is link your checking account, and then Digit analyzes your spending to determine what amounts it can transfer to your (free) Digit savings account without you even noticing!

That’s literally all you have to do.

It so simple, it too me less than 2 minutes to set mine up, and of course, it’s free!

Digit is simple:

I love me some budgets, tracking my net worth and all of that, but it’s nice to do something super simple that makes me feel good every time I log in! Once you’ve set up your Digit account, every time you go to login there will be one screen displaying how much you’ve saved – so you can feel good about your savings!

The whole system is set up around text messaging, so you can text a variety of commands to Digit, and Digit will replay with either an answer to your question, or completing the transfer you requested.

What is the downside?

- Savings earn 0%: That’s how Digit makes their money – they get to keep the interest. You can, however, transfer your money out at any time, to an interest-bearing savings account.

- Transfers take 1 business day: You can transfer your money out at any time, but it does take 1 business day. Really, that’s pretty fast, considering with most banks transfers take between 3 & 5 business days.

- Most of the function is text massage based: which means that if you don’t have text messaging, or don’t like it, you won’t be able to do much beyond linking your account, editing your account details, and pausing savings.

- Not all banks are available: many smaller banks and credit unions are not available yet, but Digit is constantly making more and more banks available.

How to sign up:

- Visit Digit and sign up. Be sure to use the links on this page (don’t just google it) or you’ll be waitlisted.

- Enter your mobile phone number & Digit will send you a confirmation code

- Once you confirm, you’ll get a “Hi & Nice to meet you” text from Digit

- You’ll connect your bank account by logging into online banking

- The, confirm your account and routing number

You’re all set up! Digit will begin analyzing your account and you’ll see your first savings transfer in 2-3 days

I know you have questions….(I did!)

How does Digit work?

Every few days, Digit checks your spending patterns and moves a few dollars from your checking account to your Digit account, if you can afford it. Easily withdraw your money any time, quickly and with no fees.

What makes Digit different than a recurring bank savings transfer?

Digit automatically figures out when and how much is safe to save based on your lifestyle. Digit doesn’t require you to figure out an arbitrary amount to transfer every month.

Is Digit safe?

Yes. Digit uses state-of-the-art security measures. Your personal information is anonymized, encrypted and securely stored. All funds held within Digit are FDIC insured up to a balance of $250,000.

Does Digit cost anything?

Digit is completely free. You will see “Hello Digit Inc” transactions in your checking account but these transactions are just transfers to and from Digit.

What is the Digit no-overdraft guarantee?

We believe so strongly in our math and the ability to safely identify money you don’t need that if we overdraft your account we’ll pay the fee.

Where is Digit currently available?

At this time, Digit supports over 2,500 banks and credit unions within the United States.

Does Digit work with banks located outside the United States?

Unfortunately, Digit is U.S.-only right now. We have hopes to expand internationally in the future.

Do I need a savings account?

No. When you signup for Digit you get your own Digit account which will hold any Digit savings until withdrawn. Any funds held in your Digit account are FDIC insured up to a balance of $250,000.

How do I access my Digit savings?

You can withdraw your savings 24/7/365 and as many times as you want per month. Just text Digit ‘Withdraw’ if you’d like to move money from Digit to your checking account.

How does Digit make money?

We are able to offer Digit as a free service because any interest earned on your savings funds our operations. We plan to offer ways to get a return on your savings in the future.

What should I do with my Digit savings?

Some of our users have started a fund for emergencies, splurged on a trip, or paid down debt. You can also move your savings to other accounts (for investments or retirement) as often as you wish.

Check out Digit.co and start saving!

This post may contain affiliate links. See my disclosures for more information.

I’ve heard really great things about Digit from Making Sense of Cents as well, I really want to give it a shot!