I wanted to provide a little update from when we started (August 2013) to now (December 2014/January 2015) We’ve come a long way, but we’ve also made some mistakes. What we’ve found to be 100% true, though, is that frugality is hard for materialistic people like us, and that sticking to the budget will never come easy. It is a struggle every single month. However, the end result will be completely worth it!

…..aaaaaaand, here goes our balance sheet:

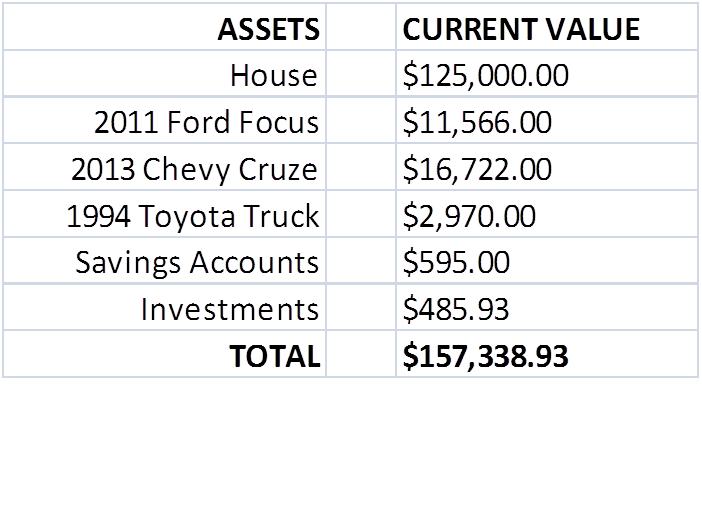

August 2013

December 2014

***Update: As you can see, our assets have gone down, but so has our debt, as you’ll see in a minute.

The house value is based on the most recent appraisal, and should go up as the market in our area improves – I hope! I won’t tell you what we bought it for until later, but let me tell you it was a steal! Oh, and the car values are from Kelly Blue book, which I realize can be off, but it is probably the most accurate source of values that I am capable of using. Seriously, have you tried to determine a car’s value from private party listings before? Its terrible, to say the least…

We used to have quite a bit more in savings, seeing as we were working towards buying a house, but, closing costs, down payment, and $7,000 in repairs kind of decimated our savings….some days it seems like you take one step forward, and then two steps back. At least we own a house now, right?

Overall, considering we are 22 and just bought a house, I feel good about our assets. Does that make me crazy?

Old news —> However, with a baby on the way in 2 months, and my maternity leave being unpaid, there is an income gap that we need to fill by having it in savings before I leave work….oh the stress :-)

Now for the hard stuff:

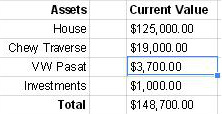

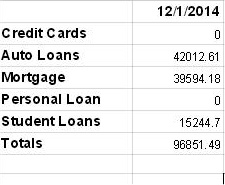

August 2013

December 2014

*****Progress has been slow. We made a couple mistakes (like purchasing a new car when I was 1 week postpartum. I’m going to blame the hormones, but that doesn’t make it suck less), but we also lowered our debt by $9,437.29….and our income is right around $36,000 a year after taxes.

Old news —-> Ugh……

Really?

I can’t say that enough times.

Right now, my focus is paying down the Personal Loan that we have. Yes, I know, its at 0.00% interest, but it is a loan from a relative, and I don’t want it sitting out there, coming between us. Money coming between family is a story I have heard too many times. Currently, we are paying $500 a month toward the personal loan balance, which means that it will be paid off in 23 months, or July 2015. We plan to put 40% of our tax return towards it as well, which would have it paid off in 16-18 months YIPPEE! Even though looking at it this way makes the payoff seem a long ways away, its really not that long.

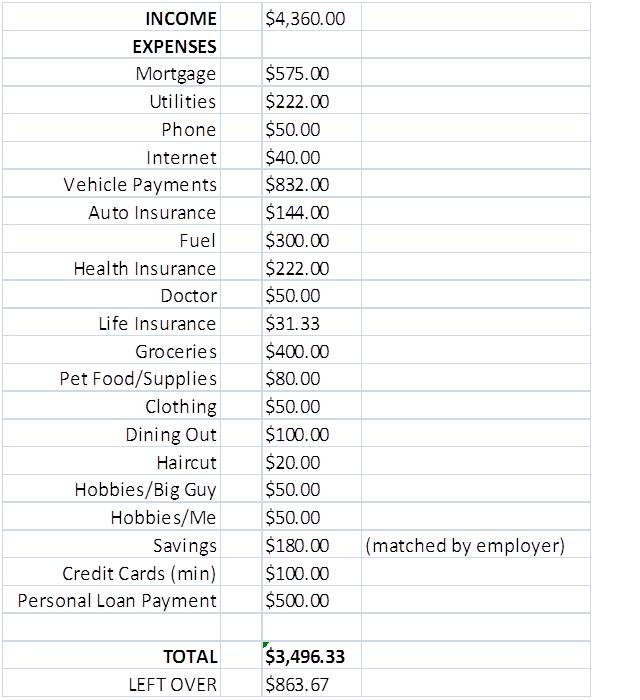

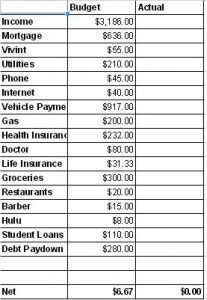

So what does our situation look like month-to-month? Here it is, folks:

August 2013

December 2014

******As you can see, not only has our income lowered, our expenditures have as well. While I get frustrated with our budget sometimes, looking back like this helps me to realize how far we’ve come!

When I look at this, there are so many ways that I could criticize myself…I could cut The Big Guy’s hair and save the $20 per month, but I am terrible at cutting hair even after many attempts, and he has to have a certain haircut because of being enlisted….but still, I should probably learn….More on this to come:-)

I could cut down on eating out, but we love to eat out so much! Let see, what else? Some categories like doctor and clothing are revolving accounts that we do not necessarily use every month, but I like to keep in the budget so we have them to use :-)

We are working on it….but it is frustrating. I’m sure others are in the same position!

*This post may contain affiliate links

[…] question – How much money do I need to live on per year? My Current Situation post detailed our current monthly expenses. Basically, with the debt we currently have, our […]