Its January Budget recap time! I both love and hate budget recap. I hate exposing my failures, but I love looking for ways to improve!

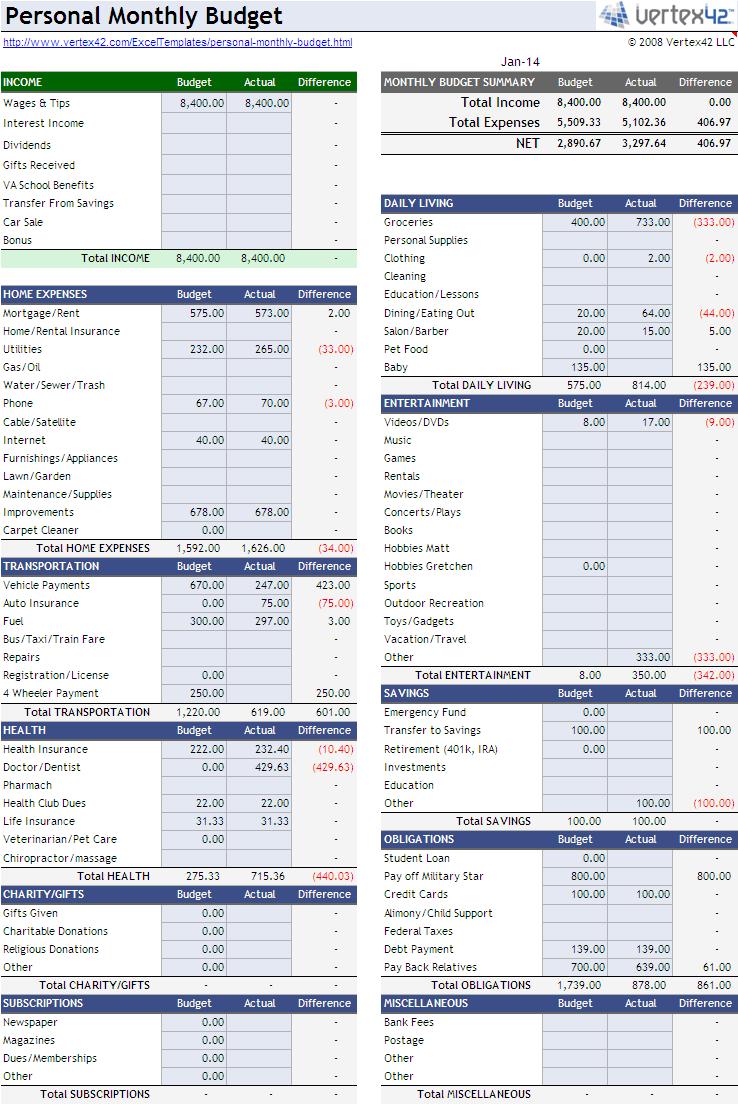

Below is the spreadsheet that I use for budgeting. It is perfect for my Type-A accountant personality :-) because it gives tons and tons of information!

Love me some percentages as well as actual vs. budget comparisons….however, The Big Guy can’t look at this – its just too much information for him to digest, so I show him our budget on Mint.com that is all color coded and pretty! Normally I use a zero-sum budget, but as you can see, this month there was just a lot of stuff…..The extra income we had come in that was not allotted to anything else went towards next month’s bills, but they haven’t actually cleared our account yet, so basically, lots of confusion…

Love me some percentages as well as actual vs. budget comparisons….however, The Big Guy can’t look at this – its just too much information for him to digest, so I show him our budget on Mint.com that is all color coded and pretty! Normally I use a zero-sum budget, but as you can see, this month there was just a lot of stuff…..The extra income we had come in that was not allotted to anything else went towards next month’s bills, but they haven’t actually cleared our account yet, so basically, lots of confusion…

Budget Failings:

- Groceries: Grrrrrr. $733 on a $400 budget. In a nutshell, we overspend at Sam’s. In theory, this will pay itself off over the next couple of months as we use some of the things we stocked up on, so I guess we will see.

- Dining/Eating Out: This is a failure as well as a success. I took our budget way down to $20 – basically just in case of emergency – because of our Budget Leak so that it would look like we could not eat out. We blew the $20 budget, but stayed within our more reasonable ( and hidden) $100 budget.

- Utilities: We went over our budget with the onset of winter, but some things like plastic over the windows, door draft stoppers, and turning the thermostat down a bit should bring us back in line next month :-)

- Auto Insurance: The Big Guy got an ATV for Christmas, so we had to get insurance on it :-( Not planned, but that is life for you…

- Health Insurance: Went up for 2014, forgot to budget for it.

- Other: $333 for The Big Guy’s Motorola Defy with Republic Wireless quit, so instead of buying him another Defy, or sending it to Motorola to be repaired (but him going without a phone for 2 weeks) we just upgraded him to the new Moto X! Once again, not planned, but such is life :-)

- Other: $100. We took $100 in cash to buy an appliance from a friend who will be paying us back at the end of February when we give it to them.

Budget Successes:

- Gas: We hit our gas budget for the first time in months! Yippeeee!

- Doctor: We went over budget, but got some things paid off from Baby RB40’s birth, so we don’t have those hanging over our head anymore!

- Improvements: We found a great deal on a dishwasher (an $800 Samsung for $377 – Whoopeeee!) and a hot water heater (50% off – yeah!) that we purchased because we had been saving for them! Also, our microwave went out (as expected) and we purchased a really nice blender/food processor for making baby food for baby RB40 here in a couple of months. Not quite planned for January, but we knew these expenses were coming up and we stayed right on budget for them.

See what I mean? Confusion everywhere!

So, my question to you is: Where can we improve? I feel like our budget is not half-bad right now, but I am always looking for ways to reduce our spending!

** Oh Hey! If you liked this post, follow me on Facebook, Pinterest, or Twitter – or all Three!

[…] @ Retired by 40! writes January Budget Update – Confusion Everywhere! – Confusion everywhere pretty much describes out month when it came to our […]