It time again for my July and August Budget Update! We had a rough July! How about you? But, we had a lot of fun, too! My aunt and uncle came down last weekend and we spent some time exploring St. Louis, including going to the Science Center, Fitz’s Soda, and Grant’s farm. We had a blast! Let’s check out how badly out budget went, shall we?

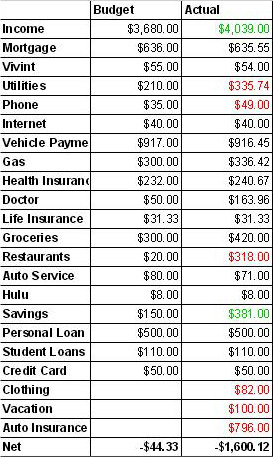

July’s Budget

July’s Budget

Wins:

- Income: It’s always a good month when income is higher than expected :-). Of course, I always budget our income a little low so that when it comes in high I am pleasantly surprised!

- Savings: I know it seems absurd that we saved more money to put towards our persona loan that usual when you consider that we had so many expenses that we over, but hear me out after you read the notes on this month.

Losses:

- Auto Insurance: This is the biggie this month! I completely forgot about or auto insurance payment! I hadn’t been saving for it monthly, and I I didn’t have a lump sum ready to go. It was actually due in June, but we never got a bill (on paper on emailed) so we randomly received this letter in the mail saying our payment was past due. I was like “What??” and quickly threw it on our new Chase Freedom card. But here’s my quandry: The Chase Freedom card is interest free until August on 2015. So, do I work on paying it off now, or do I keep putting money in savings to pay off the personal loan in December? Yes, the credit card is interest free, but putting things on it to pay off later is a slipper slope. But, if we go ahead and put money towards paying off the personal loan, once December hits it will take us less than 2 months to pay off the credit card. That’s why I went ahead and put money in savings even though we were negative this month. I want to hear from you: What should we do?

- Utilities: Oh My Goodness July was HOT! We had 2 weeks with temperatures between 95 and 100! We did the best we could on utilities, but our electric bill was $220 to the $70 that I planned!

- Phone: Not sure why this is higher. I’ve been trying to load my Republic Wireless billing statement to find out what the deal is, but that part of the website won’t load :-(

- Restaurants: Yes, it looks bad, but the spending I’m counting this month is only $70. Why? Because we budgeted the rest to be used when my aunt and uncle came into town the last weekend. Yes, it’s high but we had a great time, and I’m going to use some of our Chase Freedom $200 bonuses to cover it.

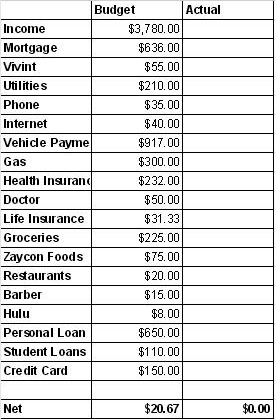

August’s Budget

Notes:

- Zaycon Foods: We’ll be trying this company for the first time in August. I’ve heard nothing but good things, especially regarding their boneless, skinless chicken breasts, so we’ll be spending $75 on 40 lbs of chicken in August. Bonus: All of their chicken is hormone-free, never frozen, and not artificial ingredients. (For those of you that aren’t good with math, that’s $1.88 per pound.) If you’re interesting in Zaycon Foods, you can sign up with my affiliate link here. I’ll be sure and let you know how we like it in October when the order comes in.

- Auto Insurance: Not sure what we’re going to do here yet :-)

- Utilities: Really hoping to get our utility cost back down after July’s craziness!

- Income: Higher than normal – probably should have mentioned that first – but on top of my paychecks, The Big Guy’s drill income, and his school pay, we have an extra $100 coming for dog sitting for 2 weeks, and an extra $500 for The Big Guy adult-sitting for 2 weeks. Basically, this older gentleman is the husband of a former coworker of his, and he is on some medication that causes him to be a bit out of it. To pay a nurse to come watch him would be $400 a day, so The Big Guy offered to do it for $50 plus gas and letting him bring our daughter over.

- Gas: The lady who is paying The Big Guy to adult-sit is also going to fill his tank twice, so that should cut down on our gas a bit, I just don’t know how much.

How did your budget shape up in July? What were your successes and failures?

*This post may contain affiliate links

Linked up at:

Think Pink Sunday, Sunday Showcase, Happiness Is Handmade,Nifty Thrifty Sunday,That DIY Party, It’s Party Time, Sunday Showcase, Around Tuit, Mix It Up Monday, Creative Mondays, Bloggers Brag ,Made By You Monday ,Monday Pin It Party ,Motivate Me Monday ,Thoughtful Spot Weekly Blog Hop ,Monday Funday, Marvelous Monday ,Titus Tuesday ,Tuesdays at our home ,Tell Me About It Tuesday ,Tip Me Tuesday ,Tuesdays With A Twist ,The Inspiration Board ,Tutorial Tuesday ,Create Link Inspire ,Making a Home ,Something Fabulous Wednesday ,The Mommy Club ,Wow Me Wednesday ,Wake Up Wednesday, Adorned From Above Wednesday, Cast Party Wednesday ,Your Whims Wednesday ,The Project Stash ,Whimsy Wednesday ,We Did It Wednesday ,Wednesday Round Up ,Wine’d Down Wednesday ,Inspire Me Wednesday ,Whatever Goes Wednesday ,Something Fabulous Wednesday ,Wow Me Wednesday ,The Pin Junkie ,What To Do Weekends, Inspiration Gallery, Artsy Corner, Inspire Us Thursday, Thrifty Thursday, That’s Fresh Friday, KitchenFun and Crafty, Friday Frenzy, Inspire Me Please, Craft Frenzy Friday, Anything Goes, Pin Me Linky Party, Pin Worthy Projects, Friday Favorites, Best of The Weekend, Link Party Palooza, Friday Flash, Flaunt It Friday, Family Fun Friday, Frugal Friday, Weekend Bloggy Reading, Saturday Show and TellS, aturday Spotlight, Strut Your Stuff Saturday, Saturday Sparks, Saturday Sharefest, Serenity Saturday, Show and Tell Saturday, Get Schooled Saturday, Dare to Share Saturday, Skip The Housework Saturday, Silver Penny Saturday, A Little Bird Told Me

Great month! I love it when our income turns out higher than expected. Both of our incomes fluctuate, so I try to guess low so that we have a surplus =)

Thanks Holly!

So what to do about car insurance on the credit card, eh? I’m not sure which I would prioritize first, it’s all debt : (. Personal choice.

But what I would do is start a sinking fund for the next installment! Plus, that seems like a very high amount for car insurance. Have you called and tried to re-negotiate the price this year?

Oh yeah! I’m definitely not forgetting about it for the next 6 months…we’re going to start saving for it now!

Unfortunately, yes, this is the lowest insurance we can find. We live in a high insurance area, plus we are under 25, and we have a new vehicle. My husband turns 25 in 6 months, and I am literally counting down the days!

Our car insurance bill was due last month as well. BOO!

I think that’s a hard decision about whether or not you should pay it off. I think it all depends on what you are comfortable with. That being said, I would rather pay off items with a higher interest rate first.

For sure! I just can’t seem to make a decision, although I am leaning towards continuing with our plan to pay off the personal loan first and then handle the car insurance bill.

It’s always great to have more income than expected! I think with an interest free card, you’re okay working on paying it off, rather than trying to pay it off in one lump sum, but you are right, it can be a slippery slope. I think as long as you limit what is being carried month to month on the card, and work at getting each purchase paid off, say within 3 or 4 months of the actual purchase date, it should be okay. That is, until the card starts to charge interest.

That’s really good advice! I think if we pay it off in January and February we’re going to be ok. I think I’m leaning towards sticking to the original plan

Hi Gretchen, Thanks for sharing this information. I must start writing down our budget rather than trying to keep it all in my head!! You have definitely inspired me! xox

You should definitely write down a budget! It will help keep you on track and honest with yourself :-)

Ouch on forgetting the car insurance… For me it happens to be in the same month I get 3 bi-weekly checks, so my extra check is basically for car insurance (yay, right?). So not budgeting for 1/6 of your auto-insurance in August?

I am not huge on budgeting to be honest, I am more into the tracking of money. Things vary like utilities so I try not to fret over something like that, but I guess it depends on how tight your cash flow is. I suppose mine will be much tighter when a kid comes around.

Nice! That works out well! And thanks for reminding me about that extra paycheck…we have have an extra one coming in September! And yeah, variable expenses are tough – especially when you budget $70 for electricity and then receive a $220 bill…..

Oh man, that sucks about the car insurance. I’d have called them up and given them an ear-full asking them how you were supposed to know what to pay if they never billed you! I think I’d let it sit there and put it toward higher interest rate debt. But that’s just me. And if that’s the only thing on that CC, then it might be nice to chip that away. So it’s sort of one of those situations where you do whatever you feel good with :)

It’s on my to-do list, LOL, but just haven’t had time. I didn’t pay the late fee, though :-)