Wow September flew by!

And from what I’m hearing, everyone else’s September flew by too! We went on vacation to Branson and Big Cedar, talked about our insurance needs, whether or not we should buy an 80-acre farm, and are gearing up to throw our little girl her 1st birthday party!

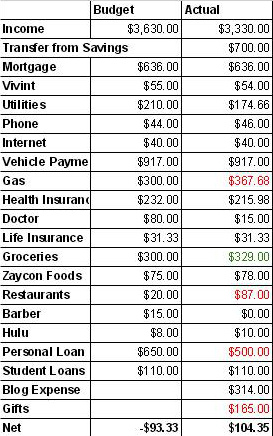

As far as our budget is concerned, we faced some challenges in September that I’m not sure we met. We’ve been having trouble keeping our grocery and gas budget in check. Also utilities have been high, but what can you do?

Wins:

- Groceries: This is the lowest number we’ve had in a while! We managed to keep our number to just over budget – and $50 of that number was actually research for a coming post, so I’m wholly comfortable with this number! We’ve had a rough couple of months, and I’m happy to report our progress!

- Utilities; finally on budget, but I don’t consider this a true win. Why? Because our electric bill is $217 for next month – and that’s our whole utility budget. Poop.

- Transfer from savings: I wasn’t really sure whether to put this in good or bad. The good is that I was able to cover some blog expenses ( a course I’m taking) with the blog’s earnings! But, I also had to use some of the blog’s earnings to cover $300 in pay I didn’t make at work this month, as well as the ridiculous amount of cost associated with gifts this month. The positive is that the blog is making enough money I could cover this added expense. The bad is that I had to use blog earnings :-(

Losses:

- Gas: This is month 3 of a terrible gas budget. We’re obviously having trouble keeping it in check, we I’m introducing weekly budget check-in’s, both here on the blog and with myself and The Big Guy.

- Groceries: We were finally in line this month, but I want to keep it that way, so we’ll be checking in on our grocery budget each week in October, as well.

- Gift: Ummmm, yeah. 2 weddings, a bridal shower, a baby shower, and buying some things for Baby RB40’s birthday in October really killed us.

- Personal loan: due to really high expenses, we decided to forgo the extra $150 toward the personal loan this month, and that stinks.

As I said above, we really, really want to stay on budget in October. September was the closest we’ve been to budget in several months, and we want to keep it that way. So, starting this saturday I”m doing weekly budget check-ins here on the blog and at home with the Big Guy.

Want to join me?

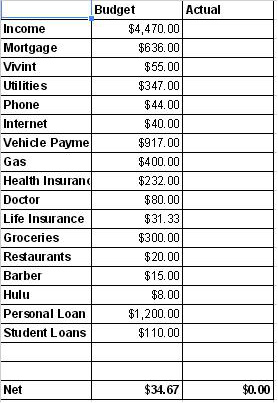

Lastly, let’s get a quick rundown of our budget in October:

A couple of things wonky this month:

- It’s a 3-paycheck month: Hip, Hip, Hooray! I love 3-paycheck months! They make our budget look so pretty, don’t they?

- Utilities are going to be astronomical: They were under last month, so it stand to reason they’ll be over this month

- Gas will be high: We’re taking a couple of trips north to see my family. Whaddya gonna do?

- We will (hopefully) put a bunch of money towards the personal loan: thanks to that 3rd paycheck.

What do you think of our budget this month? How is yours shaping up?

*This post may contain affiliate links

Stopping by from the Link-up! I recently paid off $10,000 in credit card debt and somehow I turned into a huge budgeting nerd during the process! I love reading about personal finance and budgeting now! I’m also excited about the 3 paycheck month. YAY! We’re using the extra for our down payment savings and Christmas present savings.

I came through from the Link Up too! I just started my own budgeting this past month. Trying to cut back so I can plan a move overseas next year! (and pay off 100k of student loans as well) I’m a shopaholic so its been a challenge but I like seeing other people’s budgets it shows me I’m doing ok and I’m on the right track!

Definitely! It’s so easy to be motivated in the beginning, but after a while it get hard. Good luck to you!