Now that our personal loan is paid off (!) and we took December off from super stringent budgeting, and even debt payoff over and above the minimums, we’re gearing up to hit debt hard for the new year! Here are our 2015 goals:

Finances

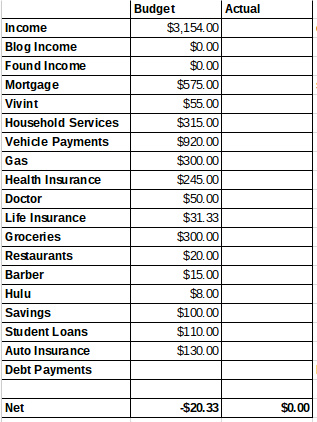

We’ve had so many changes – in income and expenses, especially. My income actually went down, but the Big Guy’s went up, and so did the blog’s. However, I am all about simplicity, so I’m simplifying our bill paying process even more for the new year. Starting now, our budget is going to look like this:

Income: Will not include anything the blog makes until it has actually been received and 30% subtracted for taxes. I had been trying to include this since I do Blog Income Updates, but it was getting so complicated. Bottom line: We are going to live on my income. Anything else gets put towards debt.

I’ve added lines for Blog Income & Found Income (tax returns, escrow refunds, etc). All of this money should be going straight towards debt.

I can’t simplify our expenses much more, but I did combine all utilities, phones & internet into 1 category. At the bottom is also a blank line for debt payments. This should equal the total amount we made from the blog and in found income each month.

This year we’re going to save money every single month. Even if it’s just $100. Or just $20. Save something and don’t touch it.

Our Expenses:

I find it valuable to look back to find out what we did wrong, and what we need to do differently in the future.

We spent an enormous amount of money in 2014. That’s it in a nutshell.

Auto Payments: $10,092 ($841 per month. Horrible, but we’re working on it)

Gas: $3,909 ($325.75 per month. We have a $300 budget, so I’m pretty cool with this)

Auto Insurance: $961 (Unavoidable. USAA has the best rates we’ve found)

Personal Loan: $11,805 (PAID OFF – whoop!)

Financial (??): $974 (I seriously have no idea what this is. About $300 is overdraft fees from the Amazon incident, but the rest I have no idea)

Mortgage: $6,927 (Pretty stinkin good….now we’re on a quest to get rid of PMI)

Home Improvement: $3,224 (Not in the budget, but also unavoidable. This was financed by the personal loan.)

Groceries: $5,328 ($444 per month, unacceptable. We can stick to $300, we just have to be creative. It is seriously a struggle every single month)

Clothing: $1,245 (Mostly for the kiddo. Seems like a lot, but I have all the clothes she will need through 3T, so this expense should go down drastically for 2015. Also, I spent $350 on clothes in November to revamp my work wardrobe, and The Big Guy needed 2 new pairs of boots this year. Had to happen after Baby RB40)

Utilities: $5,533 ($461 per month….Ummmm can someone please explain this? Definitely going to have to revise the budget line for this. Last year I budgeted $232……)

Health Insurance: $2,858 (Unavoidable)

Doctor: $2,233 (Also unavoidable, I’m just grateful it wasn’t worse.)

Taxes; $984 (Personal property tax in Missouri. Unavoidable until we get rid of the Traverse.)

Eating Out: $1,743 ($145.24 per month – Ya’ll know our struggle with eating out. At our core, we are quite lazy, and eating out is one of our favorite activities. If you read my post on When something’s gotta give, you know that I’m giving myself permission to ignore the blog at night and making more habits so that at night I actually have energy to cook. We’ll see how it goes.)

THE BIG ONE – Pay down $30,000 of debt this year.

We’re going to do this by:

- Getting a job that makes more money: I’m working with a recruiter right now, taking my time so I pick the right job. The nice thing about being an accountant is that I kind of have my pick of jobs. Of course, I still have to interview, but it’s nice not NEEDING a job immediately.

- We took our credit cards out of our wallets. Kind of speaks for itself.

- The Big Guy is getting a second-shift or part-time job. Kind of like before, but we’ll have a baby sitter for a couple of hours in the afternoon.

- Finally, we’re bringing back weekly budget check-ins. Not sure if I’m going to feature them on the blog like I did in October, but we’re definitely going to do them. Why? Because at the foundation of paying off debt is sticking to a realistic budget.

All told, we’ll need to come up with an extra $1,000 per month (on top of our regular payments) to hit this goal, but with The Big Guy bringing in $500 – $700 from his part time job, this blog, and my (hopeful) pay raise we may even exceed our goal.

Family

Once-a-Month Dates: the Big Guy and I have dreams, but we also have a kid. A very loud kid who loves to interrupt us every time we’re having a conversation. Plus, it’s really hard to concentrate when you have to keep an ear tuned for her shenanigans at all times. A reader suggested coffee shop dates once a month where we agree to talk about anything but finances. cheap and awesome bonding time.

Food Storage: While we’re not exactly preparing for the apocalypse, we do both believe that having a hefty amount of food on hand (staples, mostly) is generally a really good idea. We actually have quite a bit of basic food on hand, but we need to organize it and make sure its set up for long-term storage. Not a whole lot of money involved, just strategy.

Haircuts: I’m going to get a haircut every 2 months. At Great Clips, but still. I feel so much better when my hair is freshly cut, and $15 is totally worth it.

Potty Train the kiddo: ‘nuff said. Our potty actually came December 20th (pssst, it was only $6.50

on Amazon. As much as I hate them, they do make life easier)

Find a new job: one with benefits, my own office, and 401K matching. And more vacation. I already talked about this earlier, but I’m super excited about this goal.

Take a vacation: An honest-to-goodness vacation more than 3 days long. it will be on the frugal side (probably camping at Elephant Rock State Park) but I WILL take more than 3 days off in a row during 2015!

So that’s a lot of broad goals. I’m not going to bore you with the details, or the steps to SMART goals setting that I’ve laid out. Trust me, you’ll hear more about those in my monthly goal updates, if you’re interested.

What are your goals for 2015? Any regrets about 2014?

*This post may contain affiliate links

Congrats on paying off that $11K personal loan in 2014! That’s awesome! And, sounds like you have great goals for 2015. I really like that you’ve set goals for many different aspects of your lives–seems like a good way to stay balanced and focused. Happy New Year to you and the family :)!

Happy new year to you as well! Super excited to read about your homestead, and possibly leaving your jobs in 2015!

You’re doing great shoveling out of debt.

For Christmas, I asked my wife for a babysitter every week at the same time. So, now we have fridays from 6-9 and we can go do whatever we want – nice dinner, a hike, grocery shopping, errands, whatever strikes our fancy. A great way to spend time together and focus on OUR relationship. We do need to work on our food storage as well ;).

That’s an awesome Christmas present! I’ll definitely have to consider doing that with the hubs as well!

I think you are doing a great job. You have a plan and getting ready for 2015. We are still discussing 2015 and rethinking our plan. For sure the main focus is to make more money! Happy New Year!

Great goal! Make sure you set specifics, though :-)

Looks like you’ve got a big year ahead! Best of luck with your plans.

I’m also looking at paying off a big chunk of debt this year and plan to find a way to up my income AND cut my expenses in order to achieve it. A new job could well be on the agenda for me, too.

Really excited about 2015 – it’s going to be a great year!!!

We’re with you on the stepping up the debt payoff for this year. It HAS to go! I’m convinced 2015 will be an awesome year for those like yourselves who are committed to kicking it up a notch!

Love your 2015 goals Gretchen! Best wishes with finding a new job that you love and has the pay and benefits you desire! :)

P.S. Your Pinterest pin (http://www.pinterest.com/pin/526569381406521562/) isn’t a correct link to your post, it’s a 404 :( Just thought you would want to know! :)