March brought so many changes in the RB40 household, so let me give you the rundown:

- The Big guy is no longer a SAHD (Stay at Home Dad). He found a job he loves, so I can…

- Work from Home: I’m taking this blog and my Pinterest Marketing Business full-time. This is the balance I’ve been needing!

I’m really looking forward to summer, and seeing what I can make of this business!

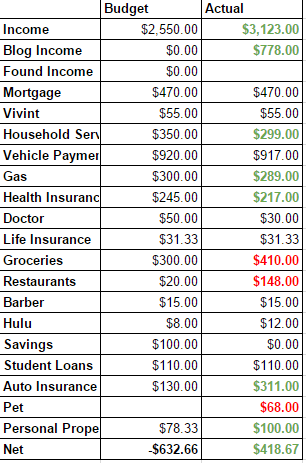

Alright, enough family stuff, here’s our budget:

This is the first month in quite while we’ve had positive cash flow!

This brings our total to $7,996 for the year, or 26.65% of our yearly goal of paying down $30,000! Even though March was a slow debt payoff month, we’re still ahead of schedule! If you want to follow along with this challenge, check out #30k2015 on Instagram!

On to the wins:

- Income: Just because of the way paychecks fell, our income was much higher than normal!

- Blog Income: Also higher than expected. This number is after taxes. Remember, I report the income I earned in my Blog Income Updates, and the money I actually receive here in my budget updates.

- Gas: $11 under, but I’ll take it!

- Household Services – as the weather turns nicer, we spend less on utilities – yay!

- Auto Insurance: This number looks bad, but it’s actually good because we prepaid by a month!

Besides Income, almost nothing was in budget, but as I explained earlier, that is partially because we made double payment again! So, here are our losses:

- Groceries: Yes, we have a grocery problem, but I’m hoping that some of it will be taken care of by me working from home. Before, we didn’t have any time, but I feel confident that I can keep our budget lower in the coming months!

- Restaurants: Our Achiles heel. However, this months was with good reason: our anniversary. We didn’t have time to go our and celebrate our 5-year anniversary in February when it actually happened, so we made time in March!

There you have it, our March Budget ups & downs! What do you think?

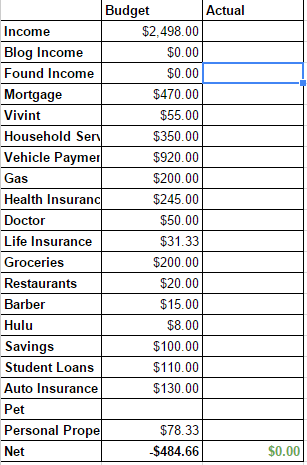

April Budget

As you can see, we’re actually short about $500, but we’re scheduled to make somewhere between $800 & $1,000 from my business after taxes. Still, I don’t want to count on it, and seeing this huge deficit in our budget motivates me to stay within or under our budget!

Also, this will be my first full month of self-employment, so I’m sure there will be tons of adjusting to be done!

Expect a lot of changes to keep coming, but no matter what, we’re doing to continue try, trying again to stay on budget!

*This post may contain affiliate links

I love when the new month rolls around and everyone starts posting their budgets!

I like the visual reminder that your current method gives you to reign in spending, but would you ever try “$0 Budgeting” as a means of trying to cut costs ahead of time? That’s what we use and it’s pretty good at keeping us in check. If it’s not in the budget, then it’s not in the budget!

Trying to plan ahead with an erratic blogging income would make it a lot harder though.

Looks like exciting times in the Retired by 40 household! What happened with the “pet” section of your budget? No expectations but then some spending? Did you get a new pet or suchlike?

Just bought your Kindle book about Pinterest – looks really good so far :-)

Good luck with the full-time blogging!