It’s time for another Net Worth Update,

And, it’s time to see how we’re coming on our #30K2015 Challenge! If you’ve been following along on Instagram, then you know what this challenge is all about! If not, that’s ok! Let me fill you in:

We set on big goal for ourselves in 2015:

Pay of $30,000 of debt

We’re going to do this by:

- Getting a job that makes more money: I’m working with a recruiter right now, taking my time so I pick the right job. The nice thing about being an accountant is that I kind of have my pick of jobs. Of course, I still have to interview, but it’s nice not NEEDING a job immediately.

- We took our credit cards out of our wallets. Kind of speaks for itself.

- The Big Guy is getting a second-shift or part-time job. Kind of like before, but we’ll have a baby sitter for a couple of hours in the afternoon.

- Finally, we’re bringing back weekly budget check-ins. Not sure if I’m going to feature them on the blog like I did in October, but we’re definitely going to do them. Why? Because at the foundation of paying off debt is sticking to a realistic budget.

All told, we’ll need to come up with an extra $1,000 per month (on top of our regular payments) to hit this goal, but with The Big Guy bringing in $500 – $700 from his part time job, this blog, and my (hopeful) pay raise we may even exceed our goal.

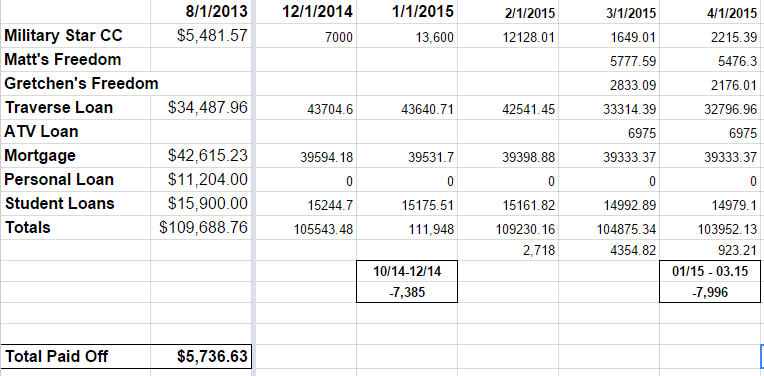

Let’s start with a look at our Debt Progress:

As you can see, (and I’ve talked about this earlier) we accumulated credit card debt, much to our dismay. It literally pains me to put this out there for everyone to see, but I’ve committed to being completely transparent with our finances, and I’m going to keep my word!

What keeps me going, putting this hard stuff out there, is knowing that other people are in the same situation. Maybe you’ve paid off credit card debt and been sooo proud of it, only to sink back into it later. I’m not going to say that it’s ok, but I am going to tell you that you’re not alone! Others are like you, and the best way to handle it is to lean on others!

But, on a more positive note, we’ve paid off $7,996 of debt in the first 1/4 of the year!

This puts us 26.65% of the way through our $30,000 goal!

We’re ahead currently, but with all of the changes happening in the RB40 household, our debt repayment may be slowing down. Or maybe not, since I just had a record month in blog income! I guess only time will tell…

Personal Loan

Gone! Whopeeee!

Which Debt to Pay off First?

Our first priority WAS the personal loan, since it was from family, but now, since we’ve gotten ourselves into credit card debt again, our priority is the credit cards.

I’m not going to address the auto loan situation here. I’ve talked it to death, and all we can do now it pay it off as soon as the Personal Loan is gone. If you want to read more about it you can check out any of my budget updates.

Net Worth:

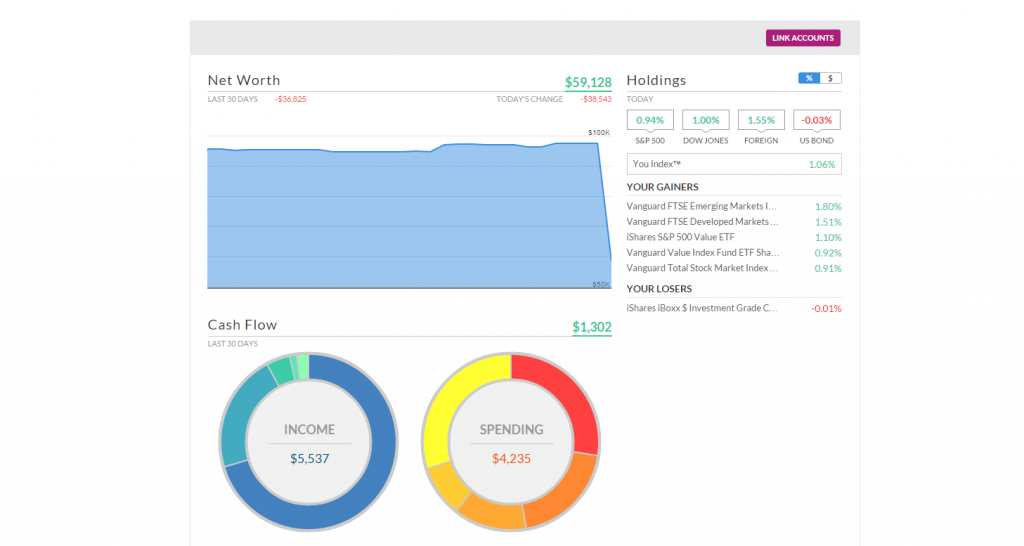

I use Personal Capital to track my net worth as well as how my (few) investments with Betterment.com

are doing. Right now my focus is paying off debt as opposed to saving, but tracking the positive (net worth) as opposed to the negative (debt) really helps me stay motivated!

According to Personal Capital our Net Worth is sitting right at $59,128! That doesn’t seem very high, but remember, I’m only 24. I have 17 more years before 40, when I want to be able to retire. This means I have about $600,000 more to go until retirement!

*Personal Capital is the best, free, online investment advisor and financial tracker. You can check out Personal Capital here!

Debt Freedom-

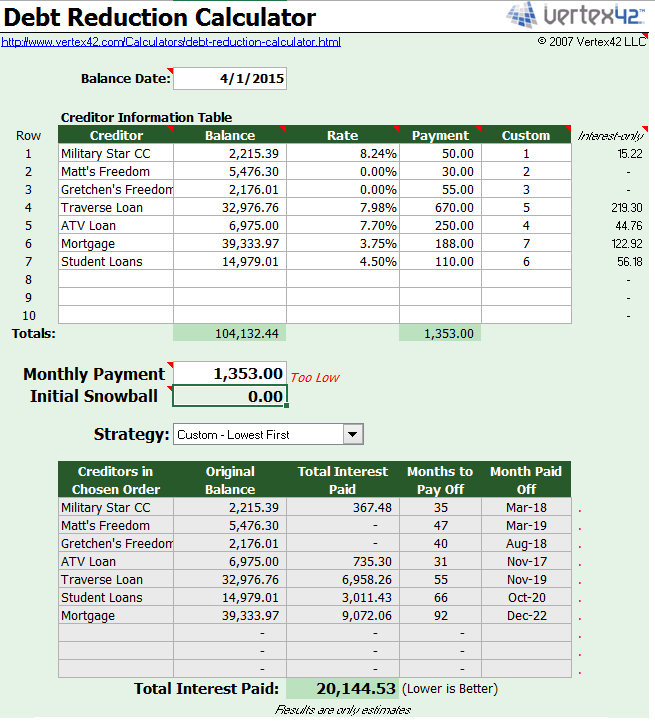

I use a free debt paydown tracker from Vertex42 Templates to track when our Debt Free Date will be. In the top section, I enter every debt, along with interest rate, amount, payment amount, and the order in which I want to pay them down.

I love this template because a) it’s free and b) because it is ridiculously detailed and flexible.

In the bottom section it shows me how many month to pay it off and how much interest I will pay in total. I played around with the order or debts to pay until I found the way (I think) I want to pay them off.

You can’t see it because it’s on the second page, but the spreadsheet gives us the amortization table for each loan, along with our debt-free date, which right now is February 2017, so we are just under 2 years away. (Except the mortgage. We plan to rent our old house out within the next 4 years, so I’m not in a hurry to pay off the mortgage) Hard to believe with more than $100,000 of debt, isn’t it?

Our debt repayment is humming right along! We’re starting to get our budget under control, so hopefully more to come!

So, what do you think? Retiring by 40 sounds aggressive, I know, but if you would like more information about how I plan to make it happen, check out How much Money to Retire by 40?

*This post may contain affiliate links

Weekly budget check-ins are awesome. We do them every month, but if you are trying to pay off debt, you have to track progress more frequently.

Oh my word, girl my mortgage alone is blowing your debt out of the water. Good for you guys working towards this and being responsible!!

We got really lucky on our mortgage – it’s the stupid car payment thats killing us!

Wow- what an incredible goal to pay off debt. And such a great way to help everyone else out with details like this.

I know more than a handful of friends who are retired by 40. It’s a wonderful thing to be able to do. I am also retired (by 40), and now I get to blog as a second career …I love t. Just be sure that you when you retire, your children are taken of care as well… otherwise, where is the relaxation ?

We need to lay off the credit cards.. it seems like we pay it, then it has a balance.. maybe we will be debt free sometimes.