Good morning!

I’m excited to share out budget update with you today, because so many exciting things are happening around the RB40 household! We’ve been having more success than ever in sticking to our budget, and we’re setting ourselves up to save even more!

We had some crazy sort of unexpected expenses this month, like $600 in car repairs (still cheaper than 1 month of car payments :-), tons of clothing The Big Guy needed for his job, and more that you’ll see below. It’s months like these that I’m reminded of how good I have it. Why? Because we could dip into the blog’s earnings for those big unexpected expenses without touching our emergency fund – and it felt good!

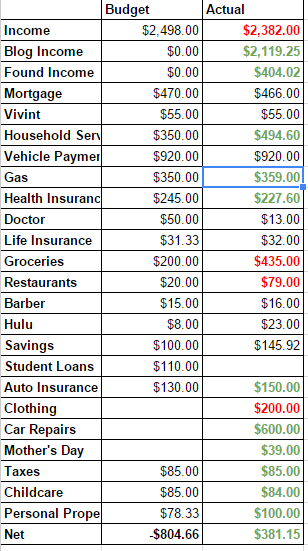

So, without further ado, let’s take a look at April’s Budget:

Like I said, crazy month, but we still came out in the green, so that makes me happy! Oh, and I messed up a little bit on the color coding this month, so forgive me?

Wins:

- Income: The Big Guy mows lawns during the summer, so her brought in some extra income doing that. Also, I pulled more than $2,000 out of this blog’s earnings to cover some car craziness and other expenses that we’ll get to in a minute. Kind of a skewed income number, but overall a win!

- Gas: Within $9 of budget. I’ll take it!

- Health Insurance: Actually under budget, but this is because we’re missing a bill from April for part of our dental insurance. Gotta get that figured out….

- Car repairs, Mother’s day, Taxes, Childcare: all were not originally budgeted for, but I’m calling them wins, because we didn’t have to touch our emergency fund!

- Savings: My new friend Digit, is really rocking the savings for me! It’s crazy because it’s so painless, I don’t even notice it! Then, when we have to buy super expensive boots for The Big Guy, all I do is text “transfer” to them, and the money get put into my checking account! You can check out Digit here!

Losses:

- Groceries: Ok, this one is tough. Remember, I include “everything you would buy at Walmart” in this budget, so this this is how our grocery budget actually broke out:

- Actual Food: $267.29

- Household supplies: $59.94

- Clothing (purchased at Sam’s Club): $122.77

- So, we were really doing pretty good, but I’m still not thrilled, especially when you consider we spent another $200 on boots for The Big Guy to wear to work….ugh!

- Household Services: I realized, as I was putting together this budget report that both The Big Guy and I still have data plans on our phones, and that’s a no-no! I’ll definitely get that taken care of ASAP, but as far as the rest of the overage, we double paid our internet and home phone bill and I neglected to factor in our trash bill, which we only pay quarterly

- Clothing: The boots I’ve been griping about. They’re supposed to last forever, and with that price tag, they had better!

- Car Repairs: I know I classified this one as a win, but I’ll talk about the “why” here in losses: Basically, the alternator, timing belt, and a couple other things that I don’t actually know what they are went out all at the same time. It sucked, but we did save ourselves at least $1,000 by doing ourselves (with the help of my brother in law!)

In other news, since I’m now officially self-employed, I decided to have our neighbor watch our daughter from 9-12 Monday through Friday mornings so I could have some office hours to take/make calls, and just generally concentrated on both this blog and The Pinterest Assistant (which has really taken off, Yipee!) Thankfully, it’s been worth it, because between this blog and The Pinterest Assistant I actually exceeded my day job income (even after paying taxes) in April. You can read more about that in my blog income report on Monday!

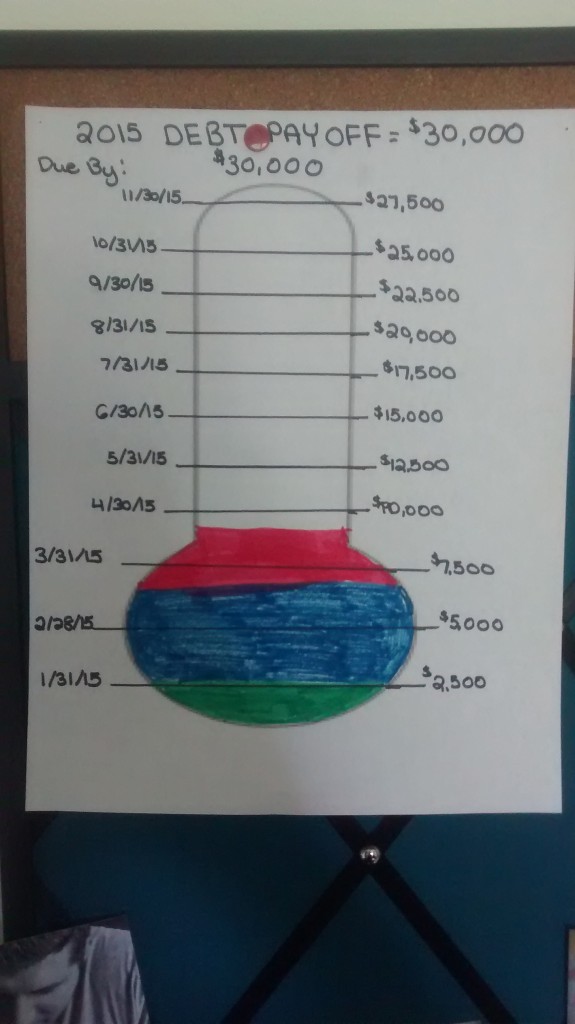

With all of that cool/not so cool stuff in mind, we need to to a #30K2014 update!

What is #30K2015??

Our one big goal for 2015 is pay down $30,000 of debt. We’re doing this in several ways:

- Getting a job that makes more money: I’m working with a recruiter right now, taking my time so I pick the right job. The nice thing about being an accountant is that I kind of have my pick of jobs. Of course, I still have to interview, but it’s nice not NEEDING a job immediately.

- We took our credit cards out of our wallets. Kind of speaks for itself.

- The Big Guy is getting a second-shift or part-time job. Kind of like before, but we’ll have a baby sitter for a couple of hours in the afternoon.

- Finally, we’re bringing back weekly budget check-ins. Not sure if I’m going to feature them on the blog like I did in October, but we’re definitely going to do them. Why? Because at the foundation of paying off debt is sticking to a realistic budget.

All told, we’ll need to come up with an extra $1,000 per month (on top of our regular payments) to hit this goal, but with The Big Guy bringing in $500 – $700 from his part time job, this blog, and my (hopeful) pay raise we may even exceed our goal.

As you can see by my super (not) exciting picture, we’ve paid of $8,413 of debt so far, which means that we’re 28.04% of the way through our goals. We’ve fallen just a bit behind, but if you plan on taking a peek at my blog income update on Monday, then you’ll see why I’m not concerned :-)

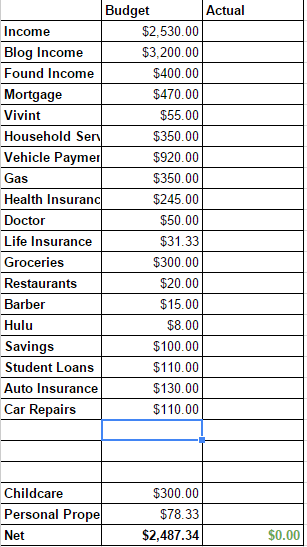

Lastly, let’s take a look at May’s Budget:

We’re planning out doing a few more care repairs, paying for childcare again, and also going camping over Memorial day weekend, sot here may be a few extra expenses, but I fully expect this to (finally) be a pretty chill month!

How well did you stay on budget in April?

*This post may contain affiliate links

I hate it when those car expenses come out of nowhere! As you pointed out, one or two months car payments would cover the cost which is why I will always by used cars!

I like how you really detail out your budget like that – looks like you’re doing a pretty good job sticking with your budget overall :-)

Good for you for being able to do the car repiars yourself. Those are pricey repairs (speaking from experience–ouch!).

Great job on paying down debt. Being debt free is life-changing. We paid $60K in debt off a few years ago. Our next goal is to get very intentional on getting the mortgage paid off.

Nicely done on the budgeting this month even with the car repairs! I had an expensive month for the same reason (radiator though) in March, but luckily my tax refund saved me there. Timing belts are not cheap and in some cars they really are a pain to even get to, so that’s great that you were able to do that without using a mechanic.

I actually enjoyed your hand drawn debt payoff picture – it’s an easy way to see your goal and progress :)

Car repairs are always a pain – they can be so expensive! Great job on paying down your debt – I’m sure you’re going to smash your goal for this year :)