Well, supposedly April showers bring May flowers – not so much in our yard, but hopefully in yours!

Last month we took the first of many short vacations. This time it was 4 days of camping over Memorial Day weekend with about 4 other families. It was hot, but really fun!

How was your month?

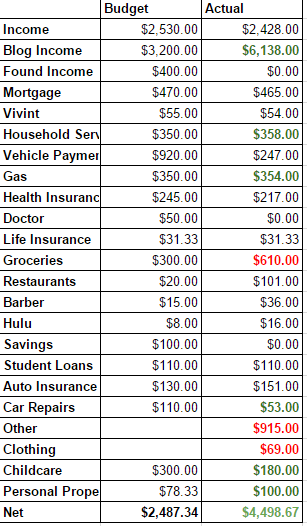

Here’s how ours shaped up:

Wins

- Blog Income: Enough said. If you want the details on how I earned this, you can read about it here

- Utilities: Yes, we were $8 over budget, but I consider it a win, especially with how hot it was

- Gas: $4 over but I’m actually really happy with that considering how much driving we did this month

- Car Repairs: It was a really bad month for our car in May. First, we had anticipated replacing a headlight and some other small part that The Big Guy said it needed. But then, A window got broken out of it, and we had to replace that too. The new window would have cost us $120 plus installation, but the Big Guy got the great idea to get one from a junkyard and watch a YouTube video to learn how to install it himself. Total window cost: $25. Then, a chunk of concrete fell off a truck on the highway and put a huge dent in the hood of the same car! The Big Guy called the company that the truck belonged to, but they wouldn’t call him back, so we filed a claim and are letting our insurance’s lawyer’s deal with it. Crazy month!

- Childcare: We ended up sending her to the babysitter less than normal so this cost was less

- Personal Property Tax: We actually only need to save $78.33 each month, but instead we saved $100, so we socked a little bit extra away

- Net Income: Amazingly, we had a surplus of almost $4,500, and so we made a $3,100 credit card payment (which you’ll see in our next Net Worth Update), kept some of the surplus to pay next month’s bills, and are going to finally put in a fence!

Losses

- Groceries: Well, we spent twice our budget. It was NOT a good month. Some of it I suppose we can attribute to camping, and the fact that I bought some convenience foods to take, but mostly, we just ate really well in May. Also, we bought 120 pounds of chicken breast from Zaycon Foods (at $1.69 a pound!), which accounted for $190 of the overspend, and that much of it I’m ok with, but the rest not so much. All of our freezers are full, and so f0r June we’re all in on a no-spend month. We will see how this goes.

- Clothing: I didn’t really expect to buy any clothing in May, but we did. Oh well…

- Other: As I was putting this report together, I really didn’t feel like adding 10 extra lines to my budget, so here is the breakdown for you:

- Household Stuff: $140 – various things like bug spray, an ice cream maker I’ve been wanting, etc

- Phone: $65 – from Republic Wireless. My phone screen has been broken for nearly a year now, and I know it’s going to give out on me one of these days, so when Republic Wireless offered $50 off any phone for Mother’s Day, I jumped on it and got us a spare phone. You never know what can happen…

- Gift: $16 – Mother’s Day

- Appraisal: $300 – We’re refinancing some of our debt through a home equity loan, so we paid $300 for an appraisal, which has yet to happen

- Gift: $48 – Father’s Day & The Big Guy’s Birthday gifts

- Camping: $160 – We made a few one-time purchases such as an air mattress, folding chairs, and a cooler, and you get the picture

- Pets: $45 – various toys, food, and immunizations

So, because of our great income month we were able to pay off one credit card completely, another significantly, and we are so excited to finally be able to put a fence up at our house. No more worrying that a kid or do will run into the yard!

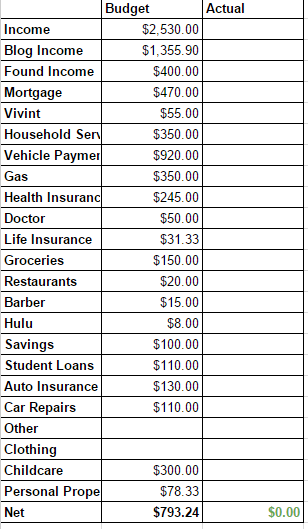

Here’s how our budget is shaping up for June:

No big surprises, except a fence might be found in the budget after it’s all said and done!

What is your plan for June?

*This post may contain affiliate links

Leave a Reply