Saving for retirement is a scary prospect.

It doesn’t matter whether you’re 13 or 53, the process (and methodology) to saving for retirement can seem overwhelming, difficult, and frustrating. But saving for retirement is a goal, just like any other goal you could set, be it weight loss, career advancement, or a big project, in that you need to think you goal through, write it down, and then create specific, achievable steps that you must take to help you achieve that goal.

When setting your retirement savings goal, there are 8 principles for saving for retirement that you must keep in mind when setting not only your retirement savings goal, but listing the steps you need to work through to get you there. Once you’ve broken it down, saving for retirement won’t seem nearly as hard!

Know How Much You Need to Save

You can’t reach you goal if you didn’t have that goal in mind in the first place, am I right? It’s an easy calculation if you have little or no debt, then you already know how much money you need each month to live off of. Simply add up you monthly expenses and viola, that’s how much money you need each month during retirement. If you have debt, the calculation get more difficult because you’ll need to consider whether you will have your current debts (or similar ones such as car payments) during retirement. If you are planning for debt during retirement (not that I recommend this) then the monthly income you need will be higher. If you plan on paying all or some of your debt off before retirement, then subtract those debt payments from your monthly expenses which will give you the amount you will need each month during retirement.

Determine How Long You Have To Save

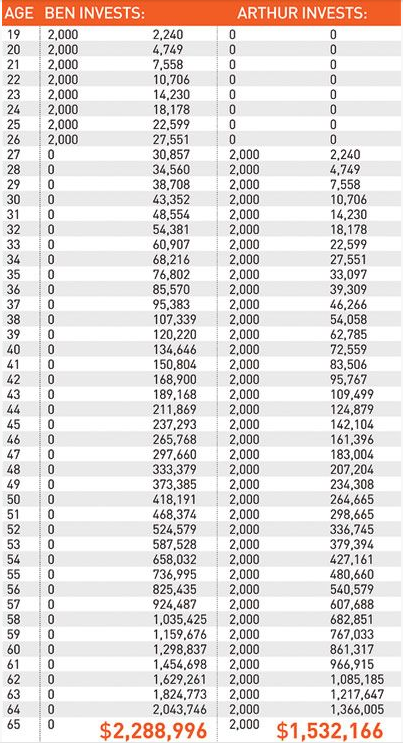

The earlier you start saving, the more time you have to save, and the longer you have to let compound interest work it’s magic. As Einstein said,

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

and he was right! (Even if he wasn’t, do you really think I would argue with something Einstein said?) A great example of this is how teenagers can become millionaires:

As you can see, the person who invests $2,000 each year from age 19 until 26 will retire with more than $2 million. There are some assumptions of course, but this is such an amazing example of the power of compound interest.

But even if you don’t choose to save $2,000 beginning at 19, you need to save a lot less per month if you have 50 years to save versus 10. Make sense?

How You Plan to Diversity

Portfolio diversification is essential to safeguard you hard-earned (and hard saved!) money from the inevitable dips in the stock market. For early investors, the more stocks the better. Sure, the stock market will rise and fall, but the overall gains over 50 or more years will result in huge gains to your portfolio. Some experts recommend a mix of cash, bonds, real estate, and stocks, but given time (another reason to start early) a combination of many different types of stocks will far outperform any other type of investment.

Index funds are the best way to go for most people. Not only do they diversify your investment for you, they’re a set-it-and forget it kind of investment that will make your life easy.

How Much Return on Investment You’re Planning For

The nature of investing in the stock market is dealing with volatility. The key is not to focus on the short-term losses, but instead to focus on the gains over the course of a year, 5 years, or even longer! Experts who study the stock market have determined that the stock market averages a 7% return per year. Sure, some years will be higher than 7%, and inevitably some years will be lower, but in the previous image, you saw how that 7% average can really add up as the years go by!

A great way to deal with volatility is to utilize index funds. An index fund will invest your money into many different types of stock, industries, as well as a range of small, mid, and large cap stocks. This way, if one industry’s returns dip for a time, the other industries gains will more than make up for the loss.

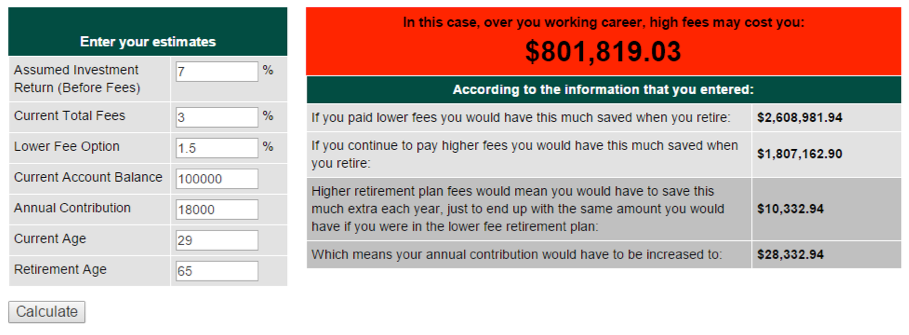

How Much You Plan to Pay in Fees

Most people don’t realize just how much of your money fees can eat up. Take at look at this example, in which an individual pay 3% in fees. 3% doesn’t feel like a lot, does it?

In this scenario, we see a 29 year old, who is currently has $100,000 in savings, and plans to contribute $18,000 per year to retirement. As you can see, fees will eventually cost this person$801,819.03 more than just cutting those fees in half, at 1.5%.

Now, most funds will not have fees this high, but this just goes to show you that you should always check out the fees on your investments, and use a calculator like this one to determine how much they will cost you.

How Much You Pay In Taxes

Regardless of your investment strategy, always max out your tax-friendly accounts such as IRAs and 401k’s to lessen your tax burden. Once you have maxed out your tax-friendly accounts, move your focus to placing high-dividend investments into tax-deferred accounts. Once you reach retirement, it is still important to consider your tax bracket and only withdraw funds that will keep you in the lowest tax bracket possible while still meeting you monthly obligations.

How Only You Can Work

The nature of the stock market is that of volatility, as I said before, and as an investor, you need to know yourself: your personality, your tolerance for for risk, and your ability to be consistent. Can you trust yourself to now get upset the first time your investments lose money? Do you know for sure that you can save the required amount of money to get your to your retirement goals? Have you left enough wiggle room in your monthly expenses so you will not be living on a strict budget during retirement?

Take all of these things into account in order to develop a winning retirement strategy.

How Well You’re On Track

An important part of setting and reaching goals is taking time to review those goals and see if your progress is setting you up to reach them. With respect to retirement strategy, it is good to have a standing appointment with yourself to review your portfolio. I recommend once per year, but more frequently if your circumstances (such as marriage, birth of children, new job, loss of job, etc) change. Evaluate your portfolio’s returns against competitor benchmarks and make changes as necessary to keep on on track to a financially healthy retirement.

There is no one-size-fits-all solution for everyone when it comes to saving for retirement. In fact, no two people’s retirement savings plan will look exactly the same because everyone has different hopes, dreams, personalities, and risk tolerances. But, if you abide by these principles and develop a well thought out plan to save, then your retirement is sure to be a financially stable one.

What retirement savings principles do you live by?

*This post may contain affiliate links

Some good points! I like the example with Ben and Arthur illustrating the importance of compounding returns. But don’t you think an example with almost 40 years of a 12% return is unrealistic?

Totally agree with this whole list! Do you think that calculating how long you expect to live is required? Or should you just plan to live on the interest that your retirement lump sum will make annually (therefore never touching the principle and not needing to be concerned with life expectancy)?

I have not sat down and figured out what I need to retire yet, and I know its way past due. I guess it would be a good idea to do this for it would be a great tool to establish a feasible plan to ensure I have enough money to retire. There has to be other people who are a little behind the power curve like me. Thanks for the tips.

Great article. Taxes are absolutely critical to consider, especially if you’ll be able to do partial conversions of IRA’s to Roth IRA’s in any low income years (like if you retire by 40 :-) ).

Did want to ask: “Once you have maxed out your tax-friendly accounts, move your focus to placing high-dividend investments into tax-deferred accounts” – I thought tax-friendly and tax-deferred were synonymous (401K’s, IRA’s) – can you clarify what you meant here?