Hi everyone!

It’s time for another budget update. I admit, I sometimes hate doing these, but since I’ve committed to complete transparency, I’m going to keep on! Also, if you’re interested, I do quarterly Net Worth/Debt Payoff Updates, which you should totally check out this month because it was a big one!

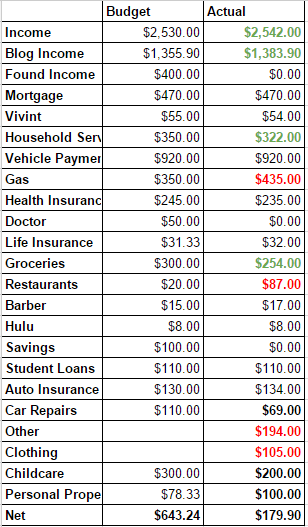

At any rate, here is how our budget shaped up for the month of June…

Wins:

- Income: High, as usual. I always try to anticipate our income lower than what it actually is, so that we budget with a buffer. Why a buffer? You’ll see why in a minute!

- Utilities: Even though temperatures were unbelievably hot, we’ve been getting used to it, and really working to keep our utilities off as much as possible – and it looks like it’s working!

- Groceries: We’re doing the 21 Day Fix right now (follow along on Instagram if you want to see what we’re eating), which means we’re buying fresh produce, like twice a week! This adds up to be more expensive than our normal fare, but $250 for a month of groceries for 3 people isn’t too bad!

- We also had a slew of expenses that were just what we budgeted for – and that makes me really happy! Right on budget is the same as a budget win!

Losses:

- Gas: Whoa! We just traveled a lot. My brother and sister-in-law were in town (from Japan!), and so we drove 45 minutes for 4 days to see them, so we could spend as much time with them as possible! Combine that with lots of trips to 6 Flags, and I think we’ll have to up our gas budget for the summer.

- Restaurants: We’ve been pretty consistently under $100 for eating out for nearly 4 months now, which I’m happy with, but not thrilled. Still, it’s a far cry from our first budget update.

- Other: This requires a little breakdown:

- $131 for home supplies like carpet cleaner, swiffer pads, diapers, etc. More than we usually spend.

- $41 for a used jogging stroller – I count this a win, because it’s the Rolls-Royce of jogging strollers, and I got it used!

- $22 dog food

- Clothing: Apparently, my husband eats his underwear for lunch, because I swear we buy him more every single month. And since $11 a pair (he’s picky!) is the cheapest price I’ve found on the kind he like, well, you can see where the money went. Is that TMI?

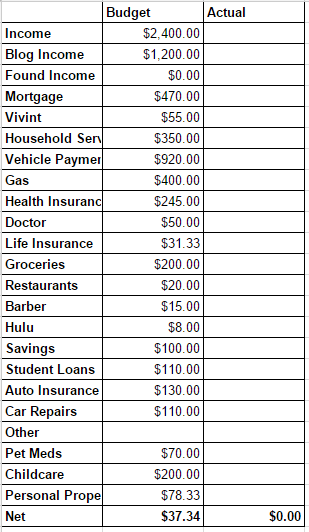

Over all, a very good month. We had some curve balls, but I felt like we handled them well. Here’s how July’s budget will look – thankfully not too many surprises:

I went ahead and raised our gas budget another $50, lowered the blog income, and accounted for the fact that we’ll need to buy heartworm and flea and tick medication for the dogs. Beyond that, we’re going camping over 4th of July weekend – and hopefully it won’t rain! – but since we’re doing the 21 day fix, I don’t really anticipate any extra groceries over, maybe $10. We already have all of our camping gear, so that’s a plus!

How’s your budget shaping up in July?

*This post may contain affiliate links

I am new to this site and i was very interested in your budgeting. I am curious. How is your Mortgage only $470? I am really curious because my wife and I are looking to buy a house in about 6 months.

Just thought I’d share a tidbit –

You can save a bit more $ on entertainment by doing gift card conversion. For example – I buy discounted Target Gift cards on cardpool @ 7% off. I then pick up a Netflix gift card and pay for it via the target gift card. They have other gift cards you can purchase there as well.

Hope that helps!