Launched in 2010, Betterment.com has become the foremost automated investing service for people like you and me who want sound investing advice with minimal fees and action required on our part.

I first became aware of Betterment.com in 2013 and I signed up almost immediately. Their easy-to-understand – and use tool made me an instant convert. My people are like me: you know you need to be investing, but don’t have the time or resources to do tons of research. By investing with Betterment you’re automatically diversifying your investments which will lead to larger, more consistent returns. On top the automated features, your Betterment account regularly rebalances and reinvests the dividends – ensuring that your money is working as hard as it can for you.

Betterment’s fees are unbelievably low for the service that they offer, currently .15% to .35%, and because of this, and their simplicity, we have almost all of our assets invested with Betterment and we’re loving it! Get up to 6 months of service free if you sign up here.

Betterment RetireGuide – Retirement Advice for Everyone

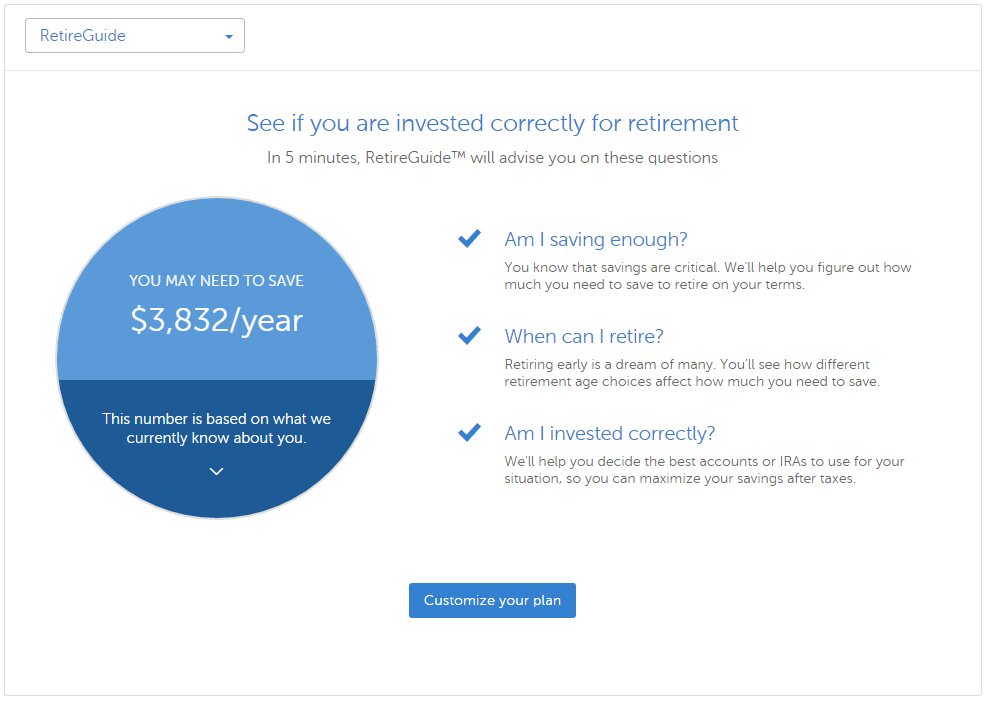

A few weeks ago, Betterment released yet another tool designed to make your investing experience – and ultimately your retirement – an easier to manage experience. They called it RetireGuide, and it is an incredible tool for investors to to get recommendations for their retirement accounts.

Betterment RetireGuide will take you through scenarios, such as whether Social Security exists or now – and the impact that each scenario will have on your retirement saving needs. It will show you what type and how much income to expect during retirement based on different scenarios as well as your current & projected savings rate. Even better, you can change the projected growth and inflation rates to be well within your comfort zone, if having complete control is your thing.

Lastly, Betterment RetireGuide gives suggestions for how to proceed and make sure that your accounts are on track for retirement.

Getting Started with Betterment RetireGuide

To access the Betterment RetireGuide, simply login to your Betterment account and click on the “Advice” tab. At the top, you should see a blue box that says, RetireGuide.

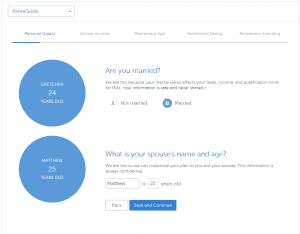

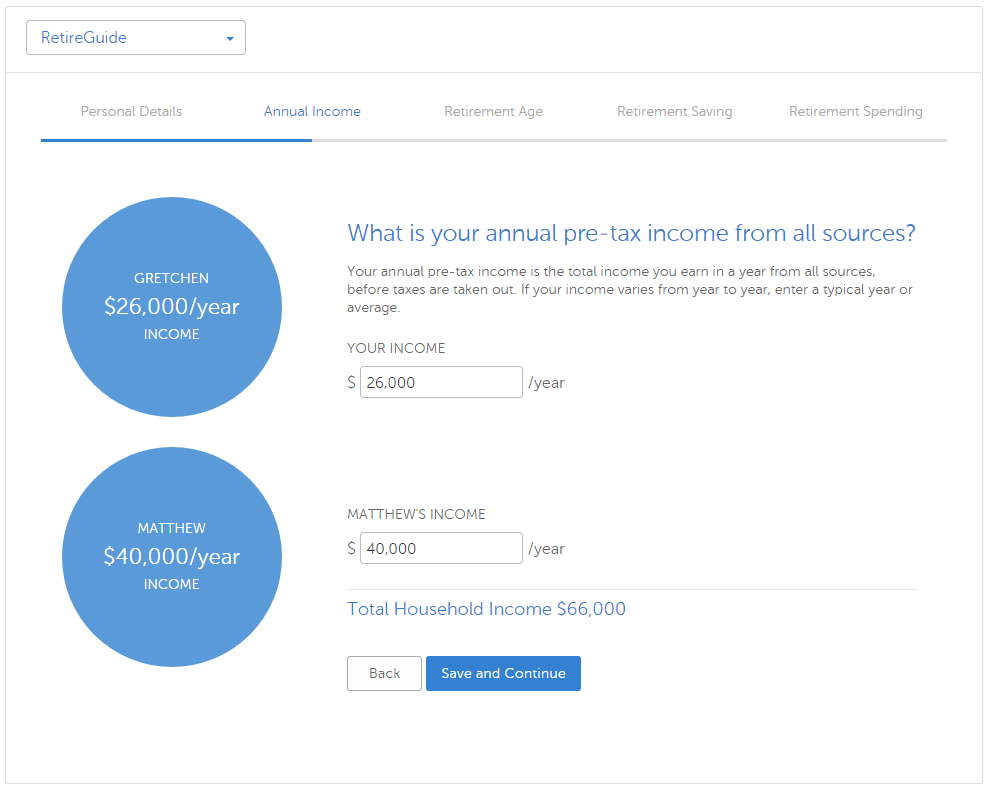

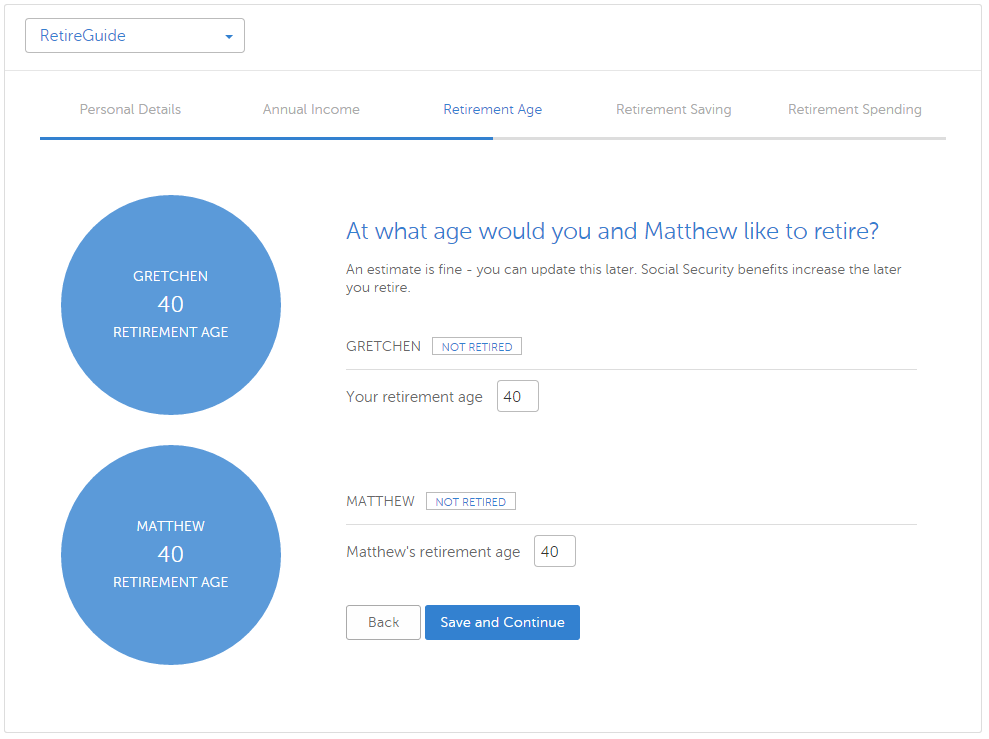

To begin, RetireGuide will take you through a series of questions about marital status, children, etc, at ascertain your current situation. It will also ask for:

- Your income

- You spouse’s income

- Your retirement age

- Your spouse’s retirement age

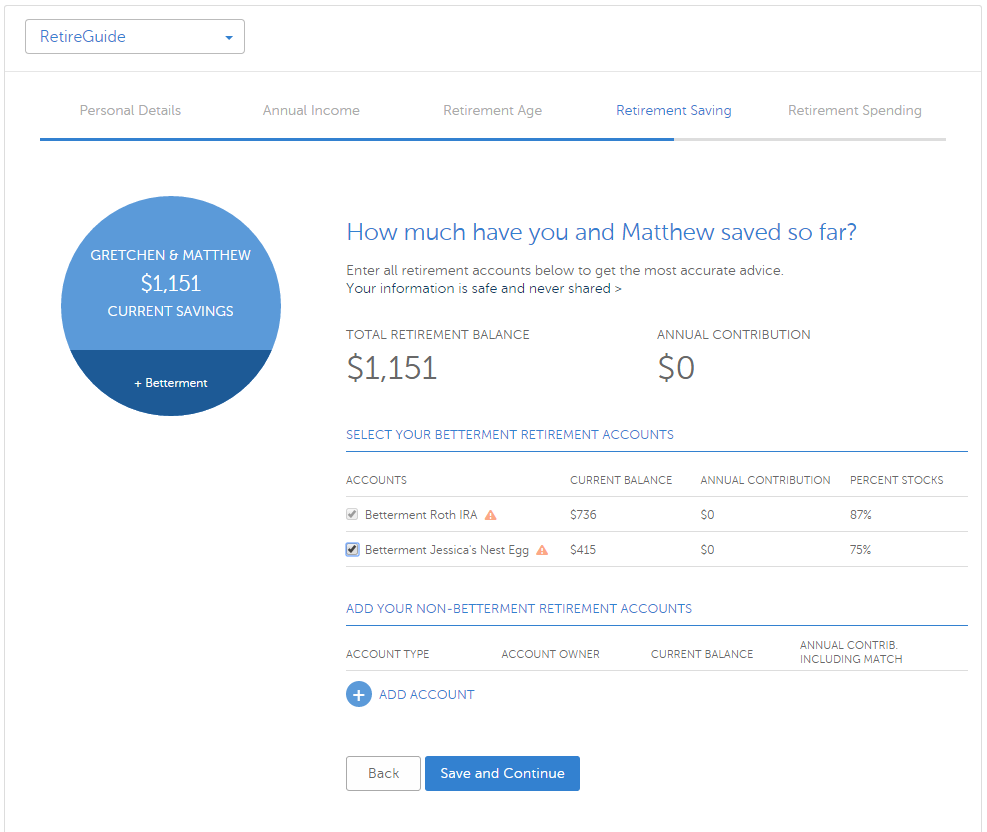

- How much you’ve already saved

- How much you save annually

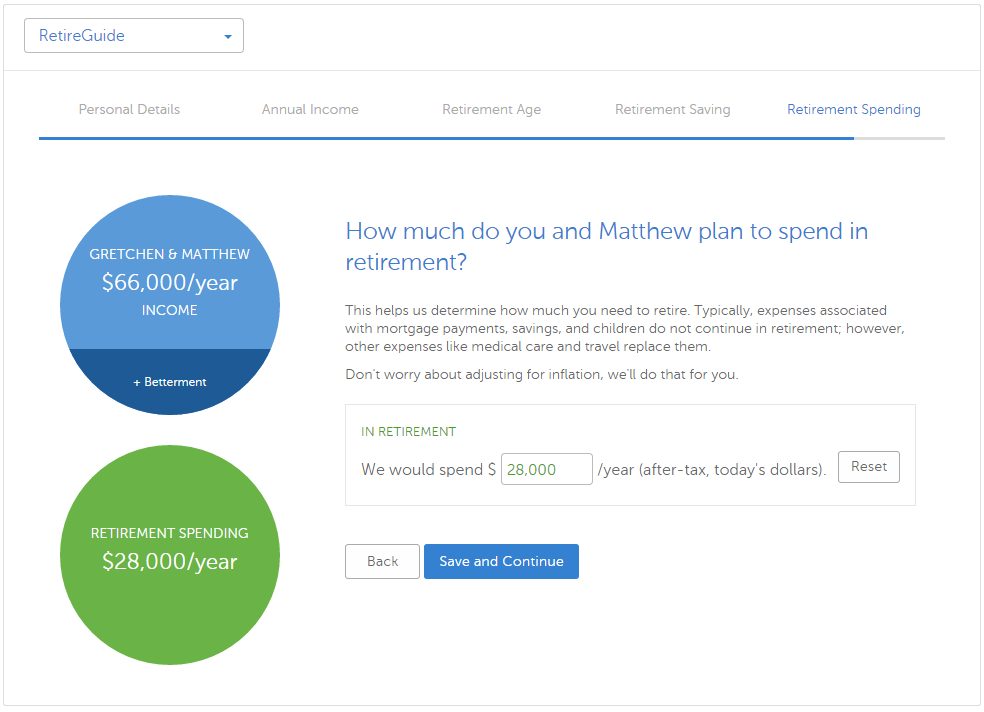

- How much you plan to spend during retirement: You can either enter your own number or use their suggestion. Their number is based on 75% of your current income in retirement, and takes your zip code into account.

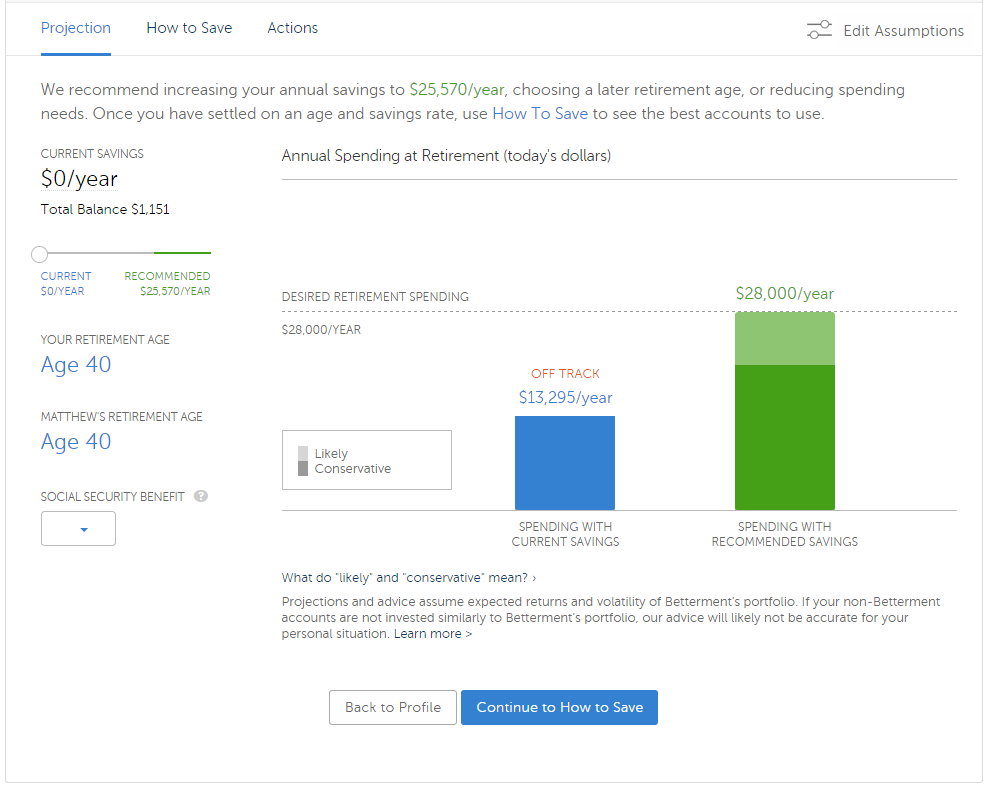

The Retirement Projection

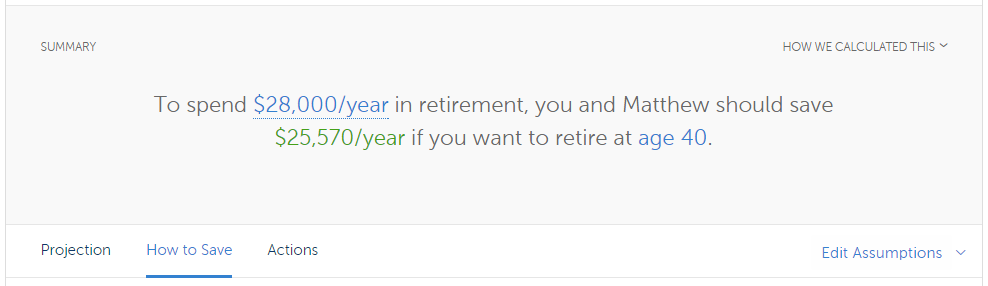

Once you have entered the initial Betterment RetireGuide questions, you will see a full summary of all of the information you’ve given.

First up will be a projection of your spending during retirement, based on your current savings trends, how much you’ve already saved, and Social Security, if applicable. If you’re projecting to spend more than your current and future savings will cover, Betterment RetireGuide will give you savings recommendations to help you reach your goals.

Here is what my screen looked like:

Since we’re currently saving $0 (because we’re more focused on getting out of debt), according to Betterment RetireGuide, we’re off track. Understandable, really.

However, it is important to note through our Budget Updates, that once we’re out of debt within the next 1-2 years, our savings will ramp up to $2,000 – $3,00 per month, putting us right within the $25,570/year savings rate that Betterment believe we need to retire by 40.

When this screen popped up initially, I found that the numbers were not accurate, but then I adjusted it to include my retirement contributions outside of my Betterment account, and the results settled comfortably into what I was anticipating – a more accurate number. Don’t forget to account for any and all retirement contributions :-)

This gives a very clear picture of how much you need to save to achieve your retirement goal in the easiest-to-understand format I’ve ever seen.

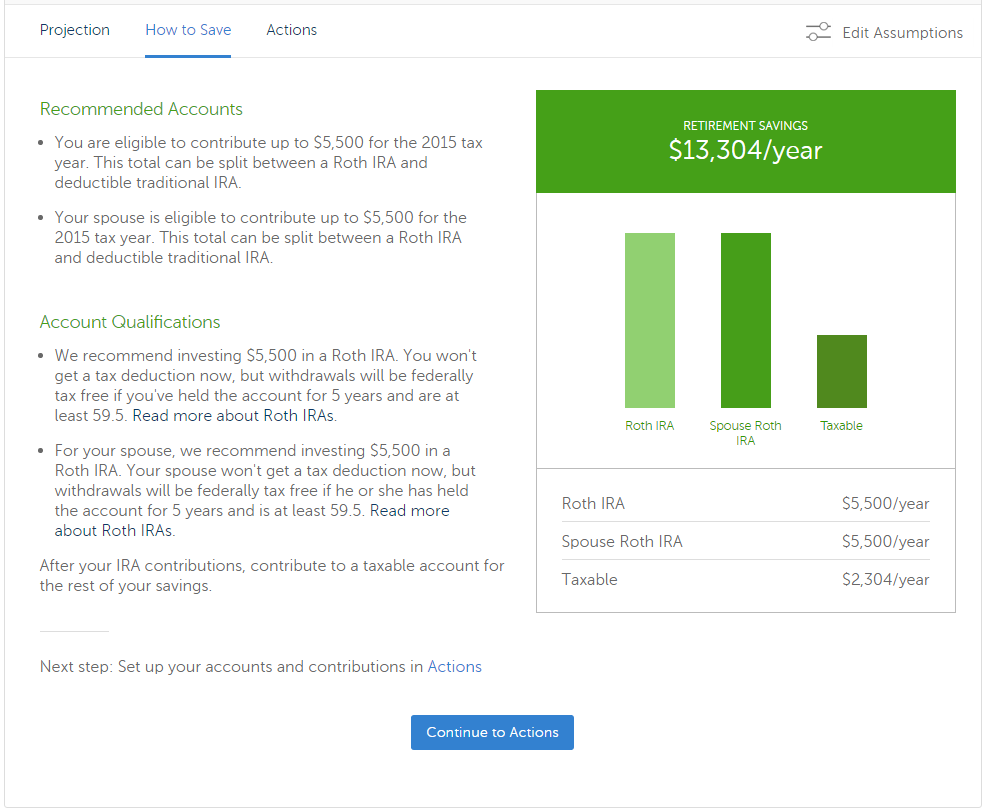

The Nitty Gritty of Saving

The next tab, How To Save, gives suggestions to make your retirement savings happen in the most tax-free way possible.

My recommendations were:

- $5,500 in my Roth IRA yearly

- $5,500 in my hubs’ Roth IRA yearly

- The rest in a taxable investment account

Taking Action

Finally, Betterment RetireGuide gives you the action steps you need. It allows you to set up the necessary accounts right then and there, adjust your automatic savings amount and more – all within the RetireGuide.

Betterment is really good at making investing easy to understand and efficient. Now, with the addition of Betterment RetireGuide, they have made staying on track for retirement easy to understand and efficient as well.

Of course, they make it simple because they want you to invest your money with them – they are, after all a business. But they’re an incredibly awesome business that I stand being.

Regardless of where you decide to invest your money, with Betterment or otherwise, Betterment RetireGuide is extremely helpful for ascertaining your retirement goals, the steps you’re currently taking to meet those goals, and the actions you need to take to bridge the gap between what you’re currently doing and what you need to be doing to live comfortably during retirement.

Have you used Betterment RetireGuide? Were you on track, off track, or otherwise?

Checkout out Betterment RetireGuide Today!

*This post may contain affiliate links

This is really cool! CNN has a retirement calculator that sort of does the same thing, but I like that Betterment personalizes it for you and tells you exactly what you should do to get ready for retirement. It is important to account for ALL retirement accounts though – like pensions (if there are any), Social Security, any money that’s been gifted to you, etc.

Oh man, I’ve used CNN’s and it scared the crap out of me – Betterment’s is way better!

I’ve never tried Betterment but this sounds like a great service, I’ll have to check it out!

Betterment is pretty sweet!