It always seems like these net worth updates come around again super fast.

And I do them every 3 months, so that’s crazy. It just goes to show you that everyone who told you that the older you get, the faster life will fly by was totally right!

First Order of Business: When Goals Change

I’ve been talking incessantly about our #30k2015 Challenge, whereby we (were) working as hard as we could to pay off $30,000 of debt in 2015. But then life changed. I talked about it in-depth in my post called When It’s Okay To Change Your Goals. If you haven’t read it, and feel up to a kind of long article, I highly suggest you take a peek at it.

But, if you’re just not up for heavy reading today, that’s ok too! Here it is in a nutshell:

$37,500

That’s the amount of interest our refinance will save us over 15 years.

Here’s the long version:

Previously, over the lives of the loans we refinanced, interest/PMI would have cost us

- $26,689 in mortgage interest

- $2,400 in PMI

$5,616 in credit card interest- $26,464 in auto loan interest

For a total of $61,169 in interest.

We bought our house for $26,204 in 2013, and in June is appraised for $87,000, which allowed us to refinance our mortgage, some extra from the auto loan, and the credit card debt at a 4.38% interest rate with no closing costs, no PMI, and for only 15 years rather than the normal 30 year term.

With some of the overage on our auto loan absorbed, we were then able to refinance our vehicle from a 7.8% interest rate down to a 2.49% rate and take 2 years off of our term – amazing!

All told, we’ll pay $20,678 in interest on the home equity loan – plus 30 year we won’t be paying on it – and we’ll pay $2,991 in auto loan interest, for a total of $23,669

When it’s all paid off, assuming we don’t pay any off early, we’ll save ourselves $37,500 in interest and PMI.

Still with me?

Awesome.

That is why I didn’t do a net worth update for Q2. Things were far too “in-limbo” to give you guys an accurate picture, and since I’m being on accuracy, transparency, and a whole bunch of other “y’s”, I just skipped it all together.

Also, the weather was amazing and I have a really fun 2-year old.

So there’s that.

But now I’m back on the bandwagon, read and willing to give you yet another devastatingly honest peek into our finances with our Q3 Net Worth and #30k2015 Challenge Update.

Let’s Roll….

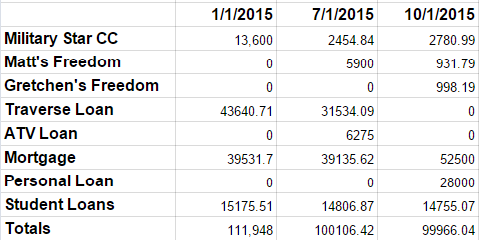

There have been about a bazillion changes since the lat net worth update, and while the amounts on this chart are accurate, their labels are a bit skewed. Our total debt paid off for the year, if you do the math on the chart is now $11,982.

But, since the #30k2015 Challenge is now about raising our net worth by $30,000 in one year, rather than just straight paying off debt, we need to take a look at assets as well!

Assets

You may notice an inconsistency in what our house and Traverse are valued at, so let me explain: I had estimated our house at $125,000 based on other houses in our neighborhood. To be fair, it was the high end of houses in our community, but I had to put something down. In June we had to get an appraisal for our home equity loan, and it appraised at $87,000. However, I’m not going to penalize our net worth gains based on something we can’t control – until the 1st of the year.

This will keep everything consistent throughout 2015 so we can celebrate the gains that we actually worked for, and then in January 2016 we will wipe the slate clean and use the accurate home value.

Make sense?

Awesome!

House: $125,000

Traverse: $24,000

Pasat: $3.700

Investments/Savings: $8,447.53

Total: $161,147.53

If you’ve been following along with our net worth updates, then you’ll know that this chart has us celebrating a couple of huge victories.

In the past, readers have asked in comments why we don’t dump the auto loan debt, and while I’ve answered their individual questions in the comments, I wanted to address it again here: We couldn’t afford to pay if off enough to sell it. We were so far underwater on it we were stuck.

But now, our Traverse is only worth $4,000 less than what we owe on it, so if we came across a good deal on a car or truck that we could afford and pay off the $4,000 extra too, we now have the option of selling it. We haven’t paid down the $4,000 though, because the loan rate is at 2.9% and we’ve earned 16% returns on our investments with Betterment in the last 2 years. So we’re keeping our eye out, and will hopefully make a move to get rid of a BUNCH of auto loan debt!

Second, our investments and savings account are the highest they’ve EVER been! That number makes me sooo unbelievably happy that I have to do a little “happy dance” here on the blog for a bit!

Final Net Worth Numbers

Celebration aside, I need to finish this up! Between our assets and debt, our net worth is now:

$61,181.49

Our net worth at the end of 2014 was $37,252, which means that the total for the first 3/4 of 2015’s #30k2015 Challenge is

$23,929.49

In order to reach our goals of $30,000, we need to accumulate $6,070.51 in the next 3 months, which may be a bit of a stretch, but we’re going to try to get as close as we can! We have a couple of large bills coming up, but like I’ve said since the beginning, even if we only reached 2/3 of our goal, that will be a huge victory!

Usually I use Personal Capital to track my net worth, but these last few months we’ve been so busy I literally did not login for 3 or 4 months. So imagine my surprise when I logged in to do this net worth update and was shocked by how accurate it was! I needed to refresh one linked account that I had changed the password to, but other than that, 5 minutes gave me the exact same result!

Personal Capital is free to use for budgeting, tracking net worth & investments, and they have cool tools like an Investment Fee Analyzer, a Retirement Planner, and things that a finance junkie like me could spend hours pouring over.

So there’s our progress? How do you track your net worth?

*This post may contain affiliate links

Linked Up

That is great! I’m too afraid of the net worth number to begin tracking mine. But it may be something I need to look into to keep motivated as it increases!

Shirria, we started tracking out net worth as opposed to just our debt, because sometimes the negativity of debt can be drag! Tracking our net worth gives us positive numbers to focus on, and even though it’s not truly “money in the bank” it feels kind of like it, and it’s definitely a nice feeling!

Great post!! Smart idea to refinance – you guys are saving a fortune!! We also have a Traverse! Man, I love that vehicle!! We’re hoping to have it paid off next summer. Those vehicles are expensive but we’re hoping it will last a good long while!

Haha, that’s awesome that you guys have a traverse, too! I love how big it is + the gas mileage, and the hubs loves that he can pull a trailer with it! That’s amazing that you guys will have yours paid off next summer – so jealous!

Wow, congrats on your progress!! That’s a HUGE interest savings with that refi! Can’t wait to see how the remainder of the year turns out! You’re doing great! :D

Just came across your blog and in all likely hood Retireby40 seems like that’s about right where I will be at for retirement age as well.

I use Personal Capital to track NW quickly, but because I do some travel hacking and credit card miles and point chasing it is sometimes hard to track budgeting and spending on there since that money looks like it is being spent when its really not… Just transferred back and forth between accounts.

With the recent market instability I have absolutely gotten hammered on my NW due to ramping up oil and gas investments for the past 2 years.. I’m interested in pick up and investing more in those companies that will survive but have to wait out that storm a bit longer. I did shift the focus on my NW as it passed above $500K more towards an income based approach looking to generate $40K a year in passive income. Ultimately I think that will be a better metric than my overall NW since my end game goal is to stop working early..

I’m also looking more at my overall debt which is not something I’ve really ever focused on.. But this year I’ve finally pushed my debt number with the mortgage included under $100K. It kind of seems like a milestone to pull that below the 6 figure mark and now that it’s getting into the ball park of something I can rationalize paying off I may do that before too long.

cheers!!!!!