Progress is based on goals.

Love ’em or hate ’em, if you want to do great things, you’re going to have to set goals and actionable steps to reach them.

This is easier than it sounds.

Setting your goals for an entire year begins with a good bit of brainstorming, dreaming, and talking with your family. My husband and I just did this with my Goal Planning Workbook (get it free when you subscribe!)

It really helped us to brainstorm what we want our life to look like by the end of 2016.

We decided that we wanted to accomplish the following things by the end of 2016:

- Buy/build a home in Troy with at least 3 bedrooms, an open floorplan (we’re willing to do demolition to accomplish this) and a fenced in yard. We’re also willing to put up the fence. We would like 5+ acres, but this is also negotiable. Our priority is good school district and turning our current home into an income property.

- Resume Thrift Savings Plan Contributions, at the maximum amount that Edwards Jones matches, possibly even 100%

- Volunteer more at the church camp we met at

- Get our passports and book a cruise, even if it isn’t until 2017

- Pay off or sell the Traverse

- If finances allow, buy a truck. Paid for in cash, of course

- Max out 401k, and contribute $100/month to my SEP IRA

We put together deadlines as well as action steps to reach these goals with Marriage & Money {get your copy here}, and then moved on to creating our budget for the year

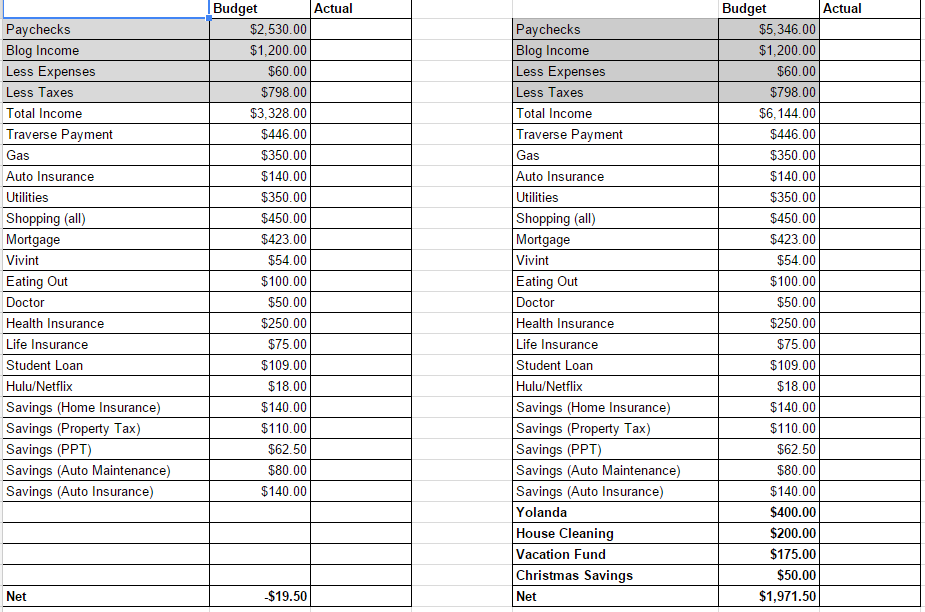

Our budget looks a little different, in that we know we’re already going to have to roll with the punches and keep our budget flexible. We took the numbers in these budgets from our spending as recorded by Personal Capital in 2015, divided the entire year’s spending for each budget line by 12, and then plugged it into our budget spreadsheet.

We like to write out budget down on paper, but I’ve gone ahead and plugged the numbers into a spreadsheet so that I can show you easier here and hold ourselves accountable!

The budget on the left is January’s budget, which as you can see, contains an estimate of the blog’s earnings, less taxes and expenses, and leaves us with loss of $19.50 per month. The budget on the right shows our plan from February on, when I will be start a new job, full-time! So, in addition to increased income, we will have additional expenses like childcare and house cleaning.

{See all of our monthly budgets}

In both budgets, we made sure to include some of our long-term goals, such as Vacations, Christmas, Auto Maintenance, and saving double for Auto Insurance, so that we can start paying in full every 6 months rather than monthly.

We will have an excess of just less than $2,000, which we will be saving for a down payment on a house, and in case you were wondering about retirement savings, we will be contributing 100% of the hubs’ National Guard pay, maxing out both of our 401k’s, and contributing to my SEP IRA. Once we purchase the new house, the excess will go into investment accounts for retirement.

These plans are all very exciting for us and we put them together using a combination of Personal Capital and the Marriage & Money Book + Planner, which is my absolute favorite combo for budgeting, since it give me back control over my money, as well as my time!

{Need a solution to the chaos of managing everyday finances? Find out why we use Marriage & Money}

Debt/Net Worth Goals

We set a few goals as far as our debt and new worth, and they do overlap a little with our overarching goals:

- Resume Thrift Savings Plan contributions, up to 100% of the hubs’ National Guard pay, and find out what percentage is matched by Edward Jones.

- Pay off or sell our Traverse

- Max our our 401k’s, and contribute $100/month to my SEP IRA

Paying off our Traverse in its entirety is quite a stretch, and so I’m leaning towards paying it down enough to sell it, and buy another car for cash. More to come on this, probably a blog post. We’re still formulating our plan!

The Thrift Savings contributions + the 401k & SEP IRA contributions, as well as any excess saved once we’ve put together the down payment for the new house, should put us at about $31,000 by the end of the year, so we’ve set a $31,000 Net Worth Increase as our Goal for the Year.

We don’t have any specific goals for debt other than doing something with our Traverse and its loan, but a plan for that is in the works!

All told, our Debt & Net Worth Goals for 2016 are ambitious, but doable, especially after our $24,000 victory in 2015 and our budget, as you saw above!

Family Goals

Our family goals are what we call our Fun Goals!

They’re things like taking vacations, spending time together, and making fun plans for the future. We set our family goals as:

- Create a chore chart for the little one

- Hire someone to clean the house 2x a month

- Get our passports and book a cruise

- Keep an eye out for a great deal on a camper, and purchase if a great opportunity arises

- Go camping at least 4 times

- Finish saving for our Disney trip!

Chore Chart

I wrote about the best chores for 2 year olds, but we haven’t been implementing them with any sort of regularity, so I would like to get that started. We’ve been noticing that our girl could really benefit from some more discipline, so I’ll be using this chore chart to start having her do daily chores.

{The best chores for 2 year olds + free printable chore chart}

House Cleaner

With the additional workload of my new job, and the fact that we’re just not naturally neat people, we’ve decided to invest in ourselves – so to speak – and hire someone to come in and clean our house 2-3 times per month. It’s expensive, but we think it will really help with our sanity.

Passports + Cruise

We were all set to do this in 2015, but then we had to do some big car repairs, and decided to do the practical thing and use our passport and vacation fund for car repairs. Sad, yes, but our credit cards and emergency fund are much happier for it! We’re going to try for this again in 2016.

Maybe Buy A Camper + Go Camping 4 Times

We go camping at least once a month right now, and going would be so much more enjoyable for me (let’s face it, I’m more of a glamper than a camper) and allow me to work while we go camping. We’re not dead-set on buying a camper in 2016, but we are committed to saving some money for one, and should a good deal arise, go for it!

Finish Saving for our Disney Trip!

We’re unbelievably excited to go to Disney in August of 2016, but we’re making it a priority to save all cash for the trip! We were fortunate enough to have family and friends who are letting us use their Disney timeshare for lodging and then bought our tickets (through the military discount program) as a Christmas presents, so all we’ll be responsible for will be our flights and meals.

Blog + Work Goals

Retired by 40! has already gotten a new look for 2016, and with that new look is a changing agenda.

While I’ll still be giving you all of the personal finance content that you know and love, the content here will be expanding in frequency and topic. As I’ve been home more, things like parenting, home decor, DIY, health & fitness, fashion, and even cooking have become more important parts of my life, and I’m excited to share them with you! You can see the plan for 2016 here, learn about the monthly giveaways I’m doing here, or get your copy of the

- Sell 1,000 copies of Marriage & Money {Shameless plug: you can get yours here}

- Post new content every single day, at least 700 words, and at least 1200 word content on Mondays and Thursdays

- Step up my Instagram Game – post 3 times daily, follow new people, and unfollow non-followers daily {You can follow me on IG here}

- Come up with a Facebook plan. More than 3,000 people like my page, but I get virtually no traffic from it. {You can follow me on Facebook here}

- Promote my posts on link-up parties again

- Guest post 2x per month

- Send out the RB40 Bi-Weekly, and test everything!

- Use Similar Web to Study Bloggers larger than myself

- Start a Facebook Group

- Launch my course – details coming soon!

- Make $3,000/month by December 2016

- Join 3 new Pinterest Group Board every single week

For my other niche blogs, I have one goal: get to 50,000 page views/month by June, following the strategies shown in Sarah Titus’ new book, How To Turn Your Blog Into a 6-Figure Money-Making Machine.

Personal Goals

I’ve been having a lot of success losing weight with Trim Healthy Mama, and giving up sugar, a process which I’ve been documenting on one of my niche sites, Fit Mom Journey. So in that spirit, I joined Chris & Heidi Powell’s January Diet Bet. I paid $30 to do it, but if I lose 4% in 4 weeks, I’ll get my money back, plus a little extra. I’ve never done a Diet Bet before, so this will definitely be an experience!

I’ve set a goal to lose 5 pounds each month in 2016, and if I like doing Diet Bet, I may continue on with it every month, or ever other month. I also have a list of classes I want to try at our gym, and hopefully I’ll get to try another new one every other week or so.

I also want to create a working space that I love, since I spend so much time in it. I don’t have any concrete ideas, but this is high on my priority list. I might make a trip to IKEA for some inspiration!

Finally, in September of 2015, I gave up sugar, and haven’t looked back, so I would like to continue that streak! A year is a long time, but the benefits I’ve gotten from eliminating sugar from my diet have been so immense that I want to continue it as long as I can, and possibly blog my way through it on Fit Mom Journey.

Our goals for 2016 are pretty all-encompassing, I think. Last year we set one big goal, but with so many things changing, we decided to go in the opposite direction in 2016. Our hope is that the variety of goals will keep us motivated!

What is one goal that you’ve set for 2016? How do you plan on reaching it?

P.S. – Share this post on Facebook, Twitter, or Pinterest for a chance at January’s giveaways!

a Rafflecopter giveaway

This post may contain affiliate links. See my disclosures for more information.

Love these goals!! I think you can definitely hit $3K per month by the end of the year! It seems like you are doing big things, so I wouldn’t be surprised if you blew this goal out of the water!!

Our “main” goal is to purchase a rental property. I also have a huge goal of hitting $10K per month by October, but we’ll see. I want most of my income to come from blogging, not freelancing, so it might take me a little longer to get to that $10K number, but I know I’ll get there some day :)

And my other priority is to simply rest. 2015 was crazy and I’d love to see more fun, travel and spending time with my family in 2016!

Happy New Year!! :)

Visiting from Inspire Me Monday at Create With Joy!

Seems like you’ve got it all figured out! I did not get an especially good financial education growing up and I feel that should be at least as important as driver education. Here’s my Inspire Me Monday post.

Good luck with your goals! I’m hoping to improve my Facebook game as well. It just seems so difficult!

Really love your goals, and I wish you the best of luck in 2016. I agree with you that people need to drop the word resolutions and replace it with goals. I just love the New Year for it really motivates you to look at your like and have the courage to make changes.

Thanks, Gretchen! Visiting from Mom’s the Word today! I very much agree with you. I wrote a post on the topic of resolutions just before New Year’s Eve also talking about seeking the Lord about His direction for the goals for the new year since He knows us best and and help us more effectively sort out priorities.