Traditional knowledge would you you believe that investment properties are a great thing, but not while you’re young.

After all, the typical investment property owner is older or very wealthy.

But if you’re young, even college aged or just starting a family, now is the time to think about affording an investment property by looking at your first home for its potential rental income rather than just a starter home to live in and discard farther down the line.

With laws that are friendly to young investment property owners, the perfect time to start thinking about an investment property is now, before you get any older.

You don’t have to have perfect credit, a large down payment or lots of cash flow. Instead, all you have to have is a little bit of real estate smarts and a desire to start investing as soon as possible, and with a purchase that you were going to make anyway: your first home.

{We Bought Our First Home At 22. Here’s How}

Another example of how traditional financial widsom has steered you wrong is the typical financial progression of an American:

- College

- First Job

- Auto Loan

- Rent An Apartment

- Get a Promotion

- Rent a Nicer Apartment

- Get Married

- Buy a House

- Start a Family

- Buy a Nicer Home

- Save for Children’s Education

- Invest For Retirment

The plan above is absolutely crazy. Instead of harnessing the power of compound interest, the plan has you scrimp and save to afford a nice life as fast as you can, stretching your finances to their limits, instead of waiting just a few years for the finer things in life so you don’t have to worry about retirement later on.

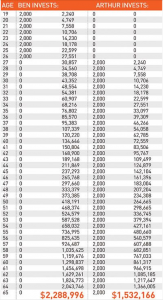

Have you ever seen the chart below?

It perfectly demonstrates why you shouldn’t wait until later in life to start investing – whether in the stock market, real estate, or any other investment.

When you’re 22, with a solid job, buying your first home is a big decision, and buying your first home to serve as an investment property later in life is an even bigger one. But even at 22, you have all of the tools you need to make it happen.

Why is now the perfect time?

You Are Young

Your credit may not yet be perfect, but having few attachments and being on your own definitely has its perks. You and you alone control what you do, what you buy, where you travel, and how you spend your money. Besides your job, you probably have few demands on your time.

If you can get out of the crazy spending habits that you’ve likely gotten from your friends – going out to the bar every weekend, buying an expensive car, etc – then you can harness the power of your easy lifestyle and work it for the long-term. Saving money for a house and developing credit in a very short amount of time is very doable. In fact, that is all you’ll really need to qualify for a loan on your first home. And your lifestyle and unnattached-ness allows you to pinch pennies for a few months to come up with down payment or home repairs cash very quickly.

{Don’t Know How To Pinch Pennies Painlessly? Start Here}

Its a Buyer’s Market

Home prices are on the rise, but they’re still very low. Even so, the most value for real estate investors lies in properties that need a significant amount of repairs. Extremely low home cost = low down payment = more cash freed up for repairs. These distressed properties are homes that have been foreclosed on that the bank is willing to sell at a loss in order to get it off their books. The low costs on these properties also help to drive down the cost of other homes in the neighborhood.

There are literally thousands of distressed properties for sale right now, and although the housing marketing is going to come back at some point, if you take advantage of prices now, buying a distressed home at far below market value allows you the chance to create a profitable investment property for the future.

Rental Income

Although you won’t reap the rewards of rental income for several years, just knowing that you have it there, in your back pocket can give a lot of peace of mind. Your mortgage payments will be much less than the market value for rent, if you purchase a distressed property, so when the time comes to rent it out, you will be able to make money

FHA Loans

FHA loans make it possible for buyers with less than perfect credit, down payments as low as 3.5%, and a higher than normal debt to income ratio to purchase homes. By the time you get around to purchasing your second home, you’ll be required to put 20% down, which is significantly more.

The only catch of an FHA loan is that you have to live on the proprety for at least a year. However, if you wanted to purchase, say a duplex or triplex, you could do so as long as you lived in one of the units. FHA mortgages are very young person and real estate investor friendly.

Why Can Every Family Afford an Investment Property

Probably one of the coolest things about purchasing your first home with investment property in mind is the unique opportunity it gives you to purchase your second home. Let me explain how this works.

Let’s use our home as an example, since the pricing seems to be pretty comparable to what is currently out there.

We purchased our home in April of 2013 for $46,000. Over the course of the first couple of months we lived there (I was pregnant with our daughter) we did $10,000 of improvements, doing much of the work ourselves and enlisting the help of family members who knew what they were doing.

All told, in August 2015, that same home appraised for $87,000. The difference between what we owed on the house (for simplicity’s sake, let’s just call it $46,000, even though we had paid on the mortgage for a couple of years) and what it appraised at is called “equity.” In our case, we had $41,000 of equity in our home that we could take out in the form of a home equity loan to do repairs, take a vacation, pay off other debt, or even use as the down payment on our second home.

Now, we can’t leverage 100% of our homes value. When talking to our bank, we found out that they would let us use up to 85% of the home’s value, which allows us to use $27,940 of the equity in our home. And because we would be required to put down 30% for the next home we purchase (you always have to put down at least 30% when purchase a second home, even if you intend to rent the first one out) $27,000 goes a long way in help that down payment out!

Every family that can afford a starter home (and I truly believe that with some expense-cutting strategies, a good side hustle, and a bit of real-estate research every single family can afford this) can afford an investment property.

It just depends upon how early that family, or individual, or couple starts thinking for the long-term.

Have you though about purchasing an investment property? What age do you think is the best for real estate investing?

P.S. Share this post on Twitter for a chance to win a copy of Marriage & Money!

a Rafflecopter giveaway

This post may contain affiliate links. See my disclosures for more information.

This is my second week to visit your blog and I always learn something of value! Thanks for sharing with the Thursday Blog Hop!