Ah, the 20’s.

College, parties, bars and relationships make up much of the first part of your twenties, and by the time you reach the second half most people are entrenched in climbing the corporate ladder, student debt, and getting married. Maybe even having babies.

Amidst all of that change, financial stress, and immaturity is there a place to start saving for retirement? Can you even start thinking about retirement before real life sets in?

{Why We’re Aiming To Retire by 40!}

The trouble with investing in your 20’s isn’t that you’re a slacker, broke, or have no financial knowledge, its that you’re incredibly busy and understandably focused on other things: college, career, and family. Money under 30 did a survey in 2015 that aimed to find out how much Millennials were earning and saving, and it found something incredible: only 46% of Millennials were saving for retirement at all.

Of the 46% of Millennials that were saving, 24% were saving 1-5% of their income and 22% were saving 6-10% of their income.

Part of that statistic is probably due to the staggering student debt numbers that many Millennials are struggling under.

The challenge for 20-somethings is overcoming the perception that you are broke, that your financial priorities lie elsewhere, and that you can’t save more, because you can ALWAYS save more. In fact, your 20’s are the best time to keep living like a college student for a few more years to sock away some serious cash into investments because you have more control over where your money goes in your 20’s than in any other time of your life.

Think about it: once a signiicant other and family comes along you have far less option to cut your spending back then when you’re single and free.

Here’s how to use your 20’s to your (retirement) advantage:

Time=Money

Nope, not time at your job. In this case, your age is your ally, as is the power of compound interest. It doesn’t matter that the economy in in the toilet, and it doesn’t matter that you’re making a pittance at your job. What matters is that when you’re 20 you have 40-50 years before retirement. And those 40-50 years can add up to hundreds of thousands of dollars.

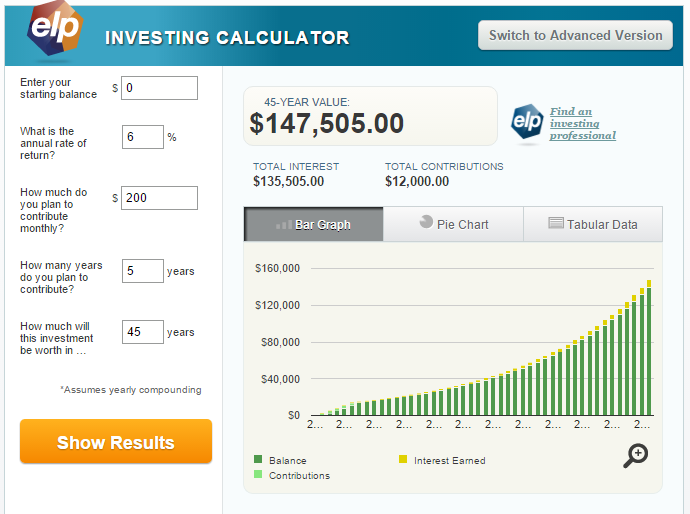

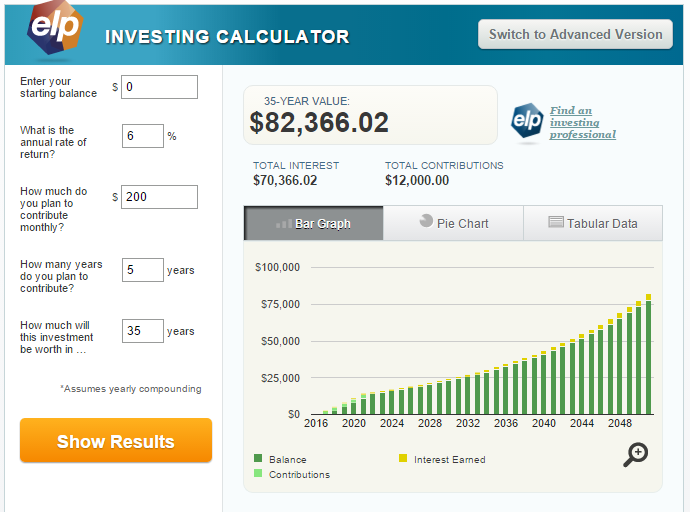

Think about this: If you start saving $200 a month – that’s only $2,400 a year – each year from age 20 – 25, you’ll have $147,505 (assuming a 6% return, and retiring at age 65). Of that ending balance, you will have only contributed $12,000 of your own money (over 5 years), and the remaining $135,505 was made up entirely of interest.

However, if you delay investing the same amount of money for 10 years, you miss out on $65,138.98 in INTEREST ALONE.

That’s just crazy.

Don’t Over-Complicate It

When you’re in your 20’s and trying to figure out how to be an adult, I completely understand if you have better things to think about than becoming an investing savant. Honestly, most people are this way and that’s ok.

That’s why we have index funds.

An index fund is just a mixture of stocks that mirror the performance of the stock market. You can invest in these stocks all at the same time, rather than one by one. Have you heard of the S&P 500? It’s an index fund comprised of 500 different companies’ stocks.

Invest with your employer’s 401(k), and then to save time and money choose an index fund from within your investing options. Or, if index funds aren’t an option, choose a low-cost target date fund (if your target retirement year is 2055, then choose the correlating fund) to get you started.

This is quick way to set and forget your investments, and then learn more as time allows. For those first few years of your 20’s, though, it’s ok to choose an easy investment just to get your retirement set in motion and so you can focus on all of the crazy happening in your life.

{Don’t Have A 401(k) Through Your Employer? Here’s the Best Option For You}

Save More, Even If You Don’t Want To

Time for some tough love: Yes, you’re busy and scared to adult, but like we talked about above, you and you alone have control of your money. Save, at a minimum 20% of your income, and if you can’t make ends meet on the 80% that’s left, then consider exploring some cost-cutting methods or getting a side-hustle. It’s only for 5 years, and honestly, you’ll survive.

{33 Ways Anyone Can Cut Expenses, Make Extra Money, and Save Their Budget}

Yes, it will seem like a sacrifice, but just remember the power of compound interest that we showed you earlier, and the fact that you’ll be WAY ahead of your peers and will be more able to enjoy life in just 5 short years without as many pressure to save for retirement.

Later on, if you lose your job, or just hate your job and decide to take a pay cut in the name of happiness, you’ll feel less pressure to save.

Embrace Risk

Statistics show that most 20 year olds who have money in investments have their money in a money market or stable value fund. While I applause these investors, the rate of return you get from these types of investments is so small it doesn’t even keep up with inflation, so they would almost be better stashing their money under their mattress.

Investing in more aggressive stock and funds does come with risk, but because you’re investing in your twenties you have plenty of time to ride out the highs and lows of the stock market. You have time to embrace risk in exchange for more growth.

Thinking about retirement in your 20s sounds like such a crazy thing. With all of the exciting changes happening in your life, it is tempting to put of saving until you’re more settled, make more money, and have more of handle on the types of investments you’re comfortable with.

But that attitude could not be further from the truth. More established = more demands on your money, and waiting until you’ve had time to read up on saving for retirement means that you’re losing out on valuable interest.

The bottom line is this: save something, even if it’s just $100 a month. Take a few surveys online, secret shop, or start a blog to come up with that money if you’re strapped for cash, and pick an index fund.

Don’t get caught up in the complicated, just invest in something during your 20’s. When you’re in your 30’s and finally feel responsible enough to make investing decisions, you can fine-tune your strategy.

For now, enjoy this phase of life and just save.

Need a low-cost way to invest that anyone can do? Check out Betterment. Their suite of tools are designed to make investing painless and their RetireGuide can help you determine if you’re on-track for retirement.

For a more in-depth look at your investments, I recommend using Personal Capital. Personal Capital is like Mint.com except its way better and provides way more information. You can link up your accounts, aggregate your transactions, and analyze your profile’s performance – with personalized investing advice. It’s the only way I manage my money, and it’s FREE.

When did you first start investing? Share what age you were with us in the comments!

P.S. If this post helped you, share this post with your friends for a chance at this month’s giveaway!

a Rafflecopter giveaway

This post may contain affiliate links. See my disclosures for more information.

Leave a Reply