It’s time for another Net Worth Update, and time to see how my debt progress is going! It’s hard to believe that we’ll be debt free in 3 years – with $100K of debt!

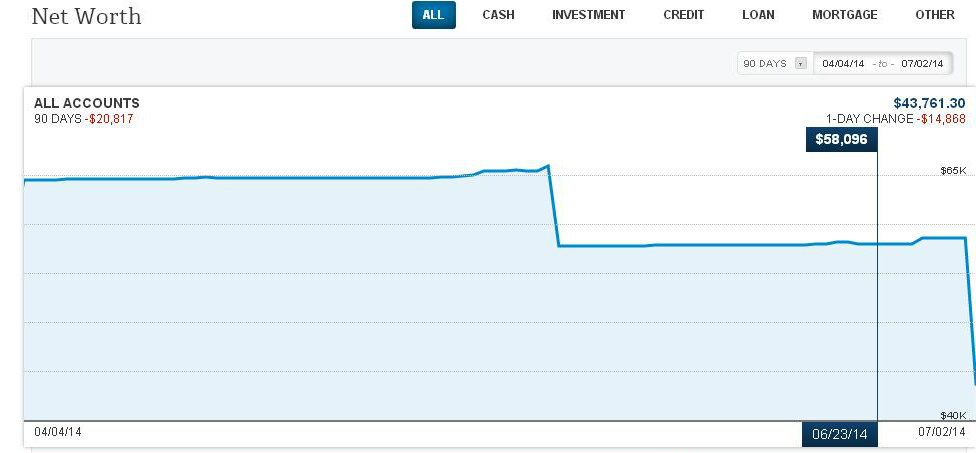

But, before I get started, I have to tell you that I failed you in my Q2 Net Worth Update. I neglected to include 2 loans into my Net Worth Calculations and into Personal Capital, so the number I gave you was totally wrong! I feel really bad, but it’s going to make this update look terrible! Let’s start with a look at our Debt Progress:

As you can see, it doesn’t look like we made much progress, but we actually did, it was just that last quarters update wasn’t accurate and I didn’t realize it. Over the last 3 months we paid off: $402.52 in credit cards, $190.49 on our mortgage, $1,500 on our Personal Loan, and$121.19 towards my student loans, for a total of $$2,133.20 towards our total debt!

Right now, the Personal Loan is our priority, seeing as it is from a family member, so the $500 extra we have in our budget every month goes to them. We are also putting everything over and above the $500 payment into savings to (hopefully) make a lump sum payment by the end of November this year and pay the whole thing off. Right now, the lump sum payment fund is sitting at $507.50. We will need a lump sum of $3,854 to pay it off in November, $1,600 of which will be taken are of by an extra check from work, and the rest is up to us! Additionally, from July until November, we can definitely put $650 a month towards it, so that will definitely help!

I’m not going to address the auto loan situation here. I’ve talked it to death, and all we can do now it pay it off as soon as the Personal Loan is gone. If you want to read more about it you can check out any of my budget updates.

Net Worth:

I use Personal Capital to track my net worth as well as how my (few) investments with Betterment.com

are doing. Right now my focus is paying off debt as opposed to saving, but tracking the positive (net worth) as opposed to the negative (debt) really helps me stay motivated! According to Personal Capital

our Net Worth is sitting right at $43,761.30! That doesn’t seem very high, but remember, I’m only 23. I have 17 more years before 40, when I want to be able to retire. This means I have about $600,000 more to go until retirement!

*Personal Capital is the best, free, online investment advisor and financial tracker. You can Personal Capital

The decrease as entirely do to me realizing that I didn’t have all of our debt in there….OOOPS! My bad…..

Debt Freedom-

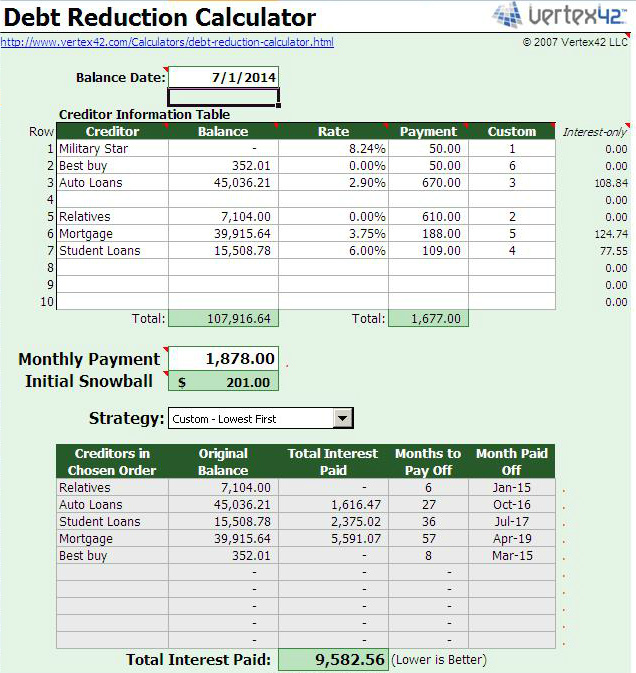

I use a free debt paydown tracker from Vertex42 Templates to track when our Debt Free Date will be. In the top section, I enter every debt, along with interest rate, amount, payment amount, and the order in which I want to pay them down.

In the bottom section it shows me how many month to pay it off and how much interest I will pay in total. I played around with the order or debts to pay until I found one that allowed me to pay the Personal Loan first, followed the the highest interest rate through the lowest.

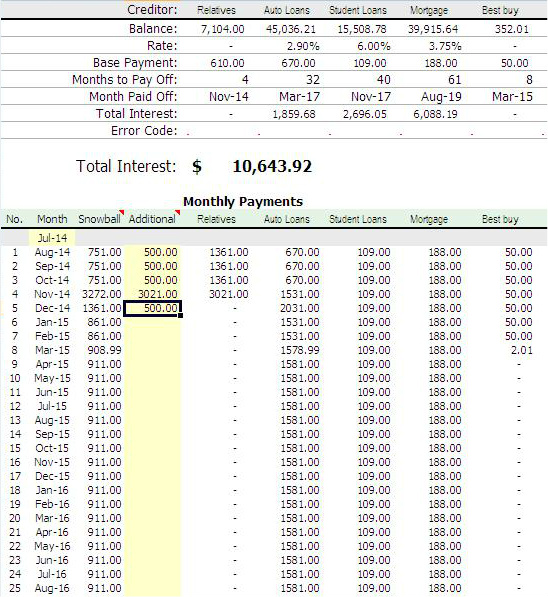

On the second page is where the magic happens:

You can’t see it, but the spreadsheet gives us the amortization table for each loan, along with our debt-free date, which right now is April of 2017, so we are just under 3 years away. (Except the mortgage. We plan to rent our old house out within the next 4 years, so I’m not in a hurry to pay off the mortgage) Hard to believe with more than $100,000 of debt, isn’t it? That doesn’t even account for the promotion I will (hopefully) get soon, so even though watching my net worth go down can be super depressing, this debt payoff calculator helps to keep things in perspective for me!

So, what do you think? Retiring by 40 sounds aggressive, I know, but if you would like more information about how I plan to make it happen, check out How much Money to Retire by 40?

*This post may contain affiliate links

Linked up at:

DIY Sunday Showcase, Think Pink Sunday, Sunday Showcase, Happiness Is Handmade,Nifty Thrifty Sunday,That DIY Party, It’s Party Time, Sunday Showcase, Mommy Monday Blog Hop, Around Tuit, Mix It Up Monday, Creative Mondays, Sweet and Savory, Show Me Your Plaid Monday,Bloggers Brag ,Made By You Monday ,Monday Pin It Party ,Motivate Me Monday ,Thoughtful Spot Weekly Blog Hop ,Monday Funday ,Busy Monday ,Marvelous Monday ,Titus Tuesday ,Tuesdays at our home ,Tell Me About It Tuesday ,Tip Me Tuesday ,Tuesdays With A Twist ,The Inspiration Board ,Tutorial Tuesday ,Create Link Inspire ,Making a Home ,Something Fabulous Wednesday ,The Mommy Club ,Wow Me Wednesday ,Wake Up Wednesday, Adorned From Above Wednesday, Cast Party Wednesday ,Your Whims Wednesday ,The Project Stash ,Whimsy Wednesday ,We Did It Wednesday ,Wednesday Round Up ,Wine’d Down Wednesday ,Inspire Me Wednesday ,Whatever Goes Wednesday ,Something Fabulous Wednesday ,Wow Me Wednesday ,The Pin Junkie ,What To Do Weekends, Inspiration Gallery, Artsy Corner, Inspire Us Thursday, Thrifty Thursday, That’s Fresh Friday, KitchenFun and Crafty, Friday Frenzy, Inspire Me Please, Craft Frenzy Friday, Anything Goes, Pin Me Linky Party, Pin Worthy Projects, Friday Favorites, Best of The Weekend, Link Party Palooza, Friday Flash, Flaunt It Friday, Family Fun Friday, Frugal Friday, Weekend Bloggy Reading, Saturday Show and TellS, aturday Spotlight, Strut Your Stuff Saturday, Saturday Sparks, Saturday Sharefest, Serenity Saturday, Show and Tell Saturday, Get Schooled Saturday, Dare to Share Saturday, Skip The Housework Saturday, Silver Penny Saturday, A Little Bird Told Me

Great job! It looks like all of your numbers are moving in the right direction. I’m sure it never feels fast enough, though =)

I’m not an expert, but looks like you’re moving in the right direction. Well done and keep up the great work x

Hi! I found your blog through a link up on livingwellspendingless.com- I think ;). I have spent so much time reading through your older posts that I kind of forget specifically where, but for some reason my memory tells me that’s where it was.

Anywho, I am also a 20something interested in retiring in the early 40s (hopefully 41/42) so that my husband can retire at 45. We started our debt free journey November 2012, the month after we were married. We just paid off our last bit of debt (student loans) and are saving to hopefully buy a house in cash!! I just wanted you to know I love the blog and will continue to read it.

Good luck on your financial endeavors!

Congratulations on starting your debt-free journey and setting such an awesome retirement goal! Good luck on your journey!

That’s amazing that you’re doing so well at such a young age! I wish I had been that smart about finances. I was never much of a spender, but I did have student loan and auto debt and if I had started paying that off sooner it would have saved me a lot of heartache in my late 20s

Good job on paying down that debt and good luck on your long term goal of retirement at 40. Eliminating debt and growing your savings and investments is a surefire way to become wealthy. With personal debt levels at all-time highs, paying down debt is something that more people should consider doing.

So right! It is astounding the amount of debt the average household has. I can’t even stomach mine, so I can’t even imagine…

You’re such a true inspiration, with the very young age you’re very responsible when it comes to financial matters. I do have debts and one of our plans is to crash it immediately as soon as possible.

That’s actually a pretty big net worth considering you’re only 23! When I was your age I think I was just starting to look into building wealth so it’s amazing what you’ve done! I wish you the best of luck!

Thank you! Sometimes it’s nice to have encouragement, especially when my net worth takes a hit like during this quarter!

Sounds like you are on a good track to retire by 40. Congratulations!

Thank for the debt repayment calculator resource.

I use the Vertex42 debt repayment calculator as well to figure out our debt free date. It’s really a great tool. I update it every few months to see if anything has changed, either for the better or the worse.

They have TONS of great templates, both simple and complicated, dont’ they?

Very impressive and at such a young age! I think you will retire by the time you’re 40 if you keep up with this. Keep your eye on the prize!

Why thank you! :-)

Thanks for sharing your net worth figures with us. Do you plan on investing in dividend paying stocks as well to supplement your future passive income?

Yes. Becuase we have so much time on our side, I don’t have a whole lot of risk aversion

Good for you on your progress! Thanks for sharing over on The Thoughtful Spot!

Thank you :-)

Congrats! I’m late to this party, but looks like you’re doing a great job getting everything paid down! I’m impressed!

Thank you! It’s definitely been a long journey, and we have a long way to go!