No, not that buy the farm. Should we buy a physical farm???

I know what you’re thinking:

That’s crazy!

To us, though, it’s not. See, my husband’s parents live on a farm that has been in the family for about 75 years. It’s not a working farm anymore, but for tax purposes, it qualifies as a farm. It is 80 acres of beautiful land, including a lake, recreational acreage, as well as tillable farmland. The Big Guy moved there when he was 13, so he has strong ties to it.

In a perfect world, I would love to have unlimited resources to clean up the farm and make it just beautiful land for my viewing pleasure. I would love to build a house overlooking the lake, maybe rent out the tillable land, and just enjoy owning 80 acres. I really have no desire for it to be a working farm. But, there are many things to consider:

What it’s worth

Right now, Zillow says the farm is worth $151,000. I realize you shouldn’t have too much confidence in Zillow estimates, but I find them interesting and we haven’t had a formal appraisal done yet. But, The Big Guy’s parents owe $165,00 on it right now (to family, but I’ll explain that in a minute).

Even knowing that, you have to realize that this farm is one of the last undeveloped pieces of land in the area. The school district is great, the areas around it are booming, and I really think that it’s worth more than what the Zillow estimate is and what my in-laws owe on it right now.

But with that being said, my father in law thinks that it’s worth half a million. That’s right, he thinks that Zillow is off by $345,000 and it’s worth $500,000. Feelings aside, I’m not willing to pay more than market value for the land. Sorry, but that’s just how it is!

It’s current state

The current state of the farm is also of concern both when we’re thinking about living there, what it would mean for our finances, as well as the current value.

It’s in shambles.

I’m being perfectly blunt here, and that’s tough to do with family, but it’s true. The house isn’t falling apart or anything – actually the house is beautiful – but it’s filled with junk. So is the property. And the barns too, which coincidentally, ARE falling apart. Everything there is very fixable with a few dumpsters, a burn pile, and some 2×4’s, but it would require some serious work.

And the state of the property definitely drags down the value.

The family mess

And then there’s this: my in-laws bought the farm from my husband’s great grandparents who are long gone now. All of the ownership paperwork is in their name, but they are still making payments (just like a 30-year mortgage) to the family members that inherited the farm (or the payments for it). However, I’m an not willing to get into loans with family.

Put mildly, my in-laws paid way too much for the farm. Besides family giving them a brutal interest rate, they’ve been paying on it for 18 years and still owe $165,000. Way, way, way too much money, not to mention the family tends to be nasty and rude about payments.

And I’m not getting into that

Assuming we can make it work, we will be going to a physical bank and getting a loan, not making payments to family.

What it would mean for our finances

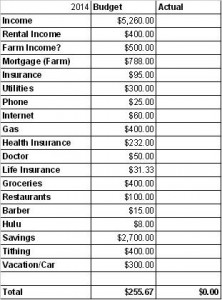

Obviously, there’s the mortgage payment. There has been some talk of us just paying what the in-laws owe on the farm, $165,000, which would give us a mortgage payment of $787.74 (assuming 4% interest rate and no down payment). But, there is more to consider.

First, we would probably need a down payment of $33,000. That’s a lot, and maybe we could utilize a special program for first-time farm buyers, or even an FHA loan. However, with the FHA loan there is obviously PMI, and I’m not sure if there’s anything like PMI with a first-time farm buyer’s loan

On top of that, we have to consider taxes and insurance. Taxes most recently were $2,200 per year, or $183.33 per month. I actually have no idea what insurance would be, so I got a rough estimate from USAA (my insurance provider of choice) and they told me it would run us about $95.00 a month.

We can also count on some sort of income coming from the farm, either from renting out the tillable land, renting out pasture, or doing hay ourselves. I’ve included that in my calculations as well.

Based on our debt level (hopefully by then) current income level, rental income and some other things, this is what we’re looking at:

There are a couple of assumptions I have to point out here.

1) I will be making 75K per year. This is in the works now, but quite frankly if I’m not making that at my current job by then I will leave for a better one :-) I’ll have the experience and an accounting degree to land a job that pays that much.

2) I included $300 of blog income in this as well. This is a modest estimate seeing as I’m already making that, but who knows what could happen?

3) Rental Income is rough, but is based on my best estimate.

4) Farm income is also very rough, but I tried to estimate a very low number, knowing that it could only go up. This is from either renting pasture, farmland, or growing and selling hay.

5) Utilities and everything else are either our current number, or increased because I know they will be more :-)

Our savings will be $2,700 per month, put toward retirement, which will actually put us just over $650,000 by the time we turn 40, which was our goal. That would give us $26,000 per year to live on. If, however, we managed to save $2,900 per month, we would end up with $27,500 to live on, which is much more comfortable when you consider the additional $4,800 per year coming in from the rental :-)

So I guess I can make retiring by 40 happen while owning the farm, but the question is: Can we get the down payment together within the 2-3 year timeline?

…but I have dream

I would really like to build a home someday. I would also love to have a large piece of land to call my own. Problem is, I’m not sure I can both retire by 40 and make my dream happen.

So I have 3 options:

1. Reduce expenses enough to make both retiring by 40 and buying the farm happen

2. Increase my income enough to make both happen

3. Give up on of the goals

….And you know I don’t take “no” for an answer.

Ever.

What do you think? Is sentiment a good reason to buy this farm? Could we make the down payment happen??

*This post may contain affiliate links

Linked up at:

Wow that’s a big step forward! I would love to live on a big open farm, although I’m not sure if I would like the manual labor. haha. You could eventually build your own custom home on the farm. You would have the land. It might take you longer. At least you would have the option.

It’s been my dream to have a big piece of land with out own house! The thinking is that we’ll live in the farmhouse for a while and then build and rent the old house out….just a theory :-)

That’s tough. Do your in-laws want to sell no matter what, or only sell if you guys buy it? That puts a different spin on it since in the second scenario you’re doing them a favor by reducing their liabilities and required cash outlay as they approach retirement. In the first scenario you’re a buyer in a (theoretically) competitive market.

If it’s really what your husband wants, why not make a deal that he needs to earn enough in side income (since he’s a SAHD these days, right?) to cover X% of the down payment. Over 3 years it’d be something like $1000/month – should be doable if he puts his mind to it! Why should all the income increases have to come from you if this is something that he wants to keep in his family?

Buying and selling property within family gets really sticky and we’re trying to stay out of it as much as possible (though Mr PoP’s parents have tried to get us to buy land at different times and we’ve declined). Right now Mr PoP’s mom has a piece of land that she co-owns with her sister (they inherited), and the sister no longer wants to pay for upkeep. My MIL offered to buy the sister’s half for a current fair price, but the sister wants what it was worth in 2007 at the height of the boom, not what it’s worth today. So MIL is up a creek without a paddle paying 100% of the expenses out of pocket in order to avoid stirring up trouble with her sister. It’s ridiculous.

Good questions – the in-laws definitely want out. It’s way too much for them to keep up with, but the won’t sell to anyone but family. Hubby’s brothers and sister don’t want it, either.

I really like the idea of making the hubby earn the money for the down payment. He is starting to mow lawns (for some strange reason he loves it) and while he won’t get rich doing that, it’s something he can do with the kiddo with very little start up costs, so I really like your idea of having him come up with the down payment!

The whole situation with mr POP’s mom is crazy – and exactly what we don’t want to get into!

Hi. Just thought I’d put in my two bits;). We own a farm right now actually so I’m on the other side. You will have to figure higher maintenance and upkeep costs for the farm also( don’t know if you are counting on this). Since most of the time you are responsible for your own water you end up paying for that- pumps filters dugout cleaning? And so many other things that you don’t have to worry about when you live in town. Even on income from the farm you will be spending if you are selling the hay since you need to cut and bale it. So either buy equipment to do it yourself or get it done custom. Not to put a damper on your idea but go into this with your eyes open!

Wow, you’re poor in-laws. Where are they going to live if you buy the farm from them? Will they live with you? Big decision but if you plan and think positive, it’s definitely worth going for. Would you subdivide and sell any of the land to developers? Is there any housing development interests there or is it too far out in the country?

What a cool opportunity!

The family part of the equation scares me though. Buying property from relatives has a potential to go really wrong… and it already sounds like it’s a sore spot in the extended family. Maybe it’s worth looking at other plots of land in the area to get a good idea of the family land’s real worth.

Zillow is worse than nothing when it comes to valuing land. They are OK for homes in the city, but land completely flummoxes their model. It’s not even a good starting point. Start looking in the sales history in the area (you may need to go back several years) to build a good price/acre model. Once you have that, then you value the house separately and add the values together to get a total valuation.

Assuming this land is productive, it could be worth a lot. Good cropland is currently priced really high compared to historical values.

Yeah, the family part is what’s getting me as well. I think we need to have a formal appraisal done to just get a baseline, and then go from there.

I always like to kind of think worst case scenario when making decisions like this. Ask yourself: What if I didn’t/didn’t want to have a job that makes 75k a year? What if I couldn’t build there and had to live in the old farmhouse forever? What if moving here meant I couldn’t retire by 40 – would I be okay with that? Also, check out the county’s property tax valuation of the house/property – that would give you a better feel for the true value of the farm, provided the assessor has been out recently. We’ve had our farm for two years now. It is A LOT of work to care for large amounts of land and an old house, but we do love the peace and quiet and beauty here, and for now, it’s definitely the right place for us. Can’t wait to hear what you decide!

Those are all awesome things to consider, although I’m not going to detail and answer here because I don’t have one. Thanks for the great perspective and the food for thought, though! I’ll definitely be sure to include this stuff when I do the answers post!

What a big decision! I know you have mentioned your husband isn’t (or won’t in the future) be able to perform manual labor. Farms require lots and lots of manual labor (I grew up on a 2,000 acre ranch). What is your plan regarding this aspect?

I would love to some day live on some acreage, so I understand your “want.” But, I couldn’t imagine taking on more debt. Would your in-laws be willing to wait 2-3 years while you pay down your debt?

You make a really good point – and you’re right. The hubs shouldn’t be doing manual labor, but that’s certainly not going to stop him. Plus, I think there’s something to be said for the happiness that comes from taking over the family farm. Oh, and I should mention we have no desire for it to be a working farm. We plan on renting out the pasture and farmland :-). Right now we’re on a 3-year plan. Our debt will be paid off in a little more than 2 years, and then we’ll be gearing up towards a down payment on the farm.

We are in a similar situation — only we don’t/won’t live on the farm that has been in the family over 125 years. It is a working farm and the income is a very welcome addition to the bottom line so that is very definitely a plus! I was also going to mention checking with the country assessors office for a current valuation. They will take into account all the variables for farm land value — soil type, water, etc. — and not just market. Be sure to ask what percentage of true value — ours is currently 96% as it was just redone. That will give you a more realistic figure to talk about until you have an appraisal at purchase time. Secondly, anytime you deal with family put everything in writing and have people sign off on any agreements you reach — even a partial agreement on the way to the big picture. Family thought I was nuts at the time — I kept saying it was for my own memory — but it has since prevented a lot of wrangling and hard feelings! Having an attorney look things over at the end is worth the cost too!

Interesting! I had never heard about checking on the percentage of true value! Thanks for all the good information! It’s so hard to keep business and family separate, but sometimes you just have to!

I know this is an old post but my husband and I have been thinking seriously about buying a farm and I came across it. I’m curious if you did end up buying the place and, if so, did you end up hiring a professional to help you iron out the value issues? I feel like, especially when dealing with a family situation like that, it would be incredibly helpful to have an objective third party who can make sure no one got taken advantage of.