It’s time for another Net Worth Update,

and time to see how my debt progress is going! It’s hard to believe that we’ll be debt free in a little more than 2 years – with $100K of debt!

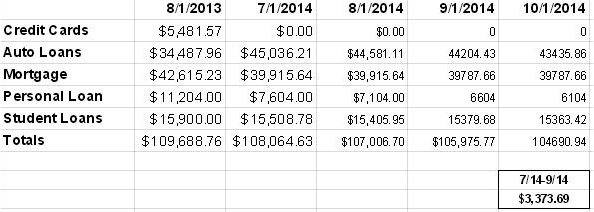

Let’s start with a look at our Debt Progress:

$3,373.69

$3,373.69

That’s the debt we have paid off in the last 3 months! Whether your’e on a tight budget, or a super lenient one, that’s something to celebrate! It works out to $1,124.56 per month – and obviously we’re super happy about that!

Personal Loan

This is our priority right now, because it is a loan from the Big Guy’s grandparents. If we continue paying $500 a month towards it, plus the lump amount we’ve been building in savings to pay it off completely, we’ll have it paid off in May! Hopefully, we’ll have it paid off sooner, though, because the Big Guy is expecting a bonus of about $3,500 in February. But, we’re not counting our chickens before they hatch and even factoring that into our plans :-)

Which Debt to Pay off First?

This is a super tricky question. Obviously, we’re paying off the personal loan first, since we don’t like owing money to family, but after that it gets really tough. I wrote a post on this, and you can read it here.

I’m not going to address the auto loan situation here. I’ve talked it to death, and all we can do now it pay it off as soon as the Personal Loan is gone. If you want to read more about it you can check out any of my budget updates.

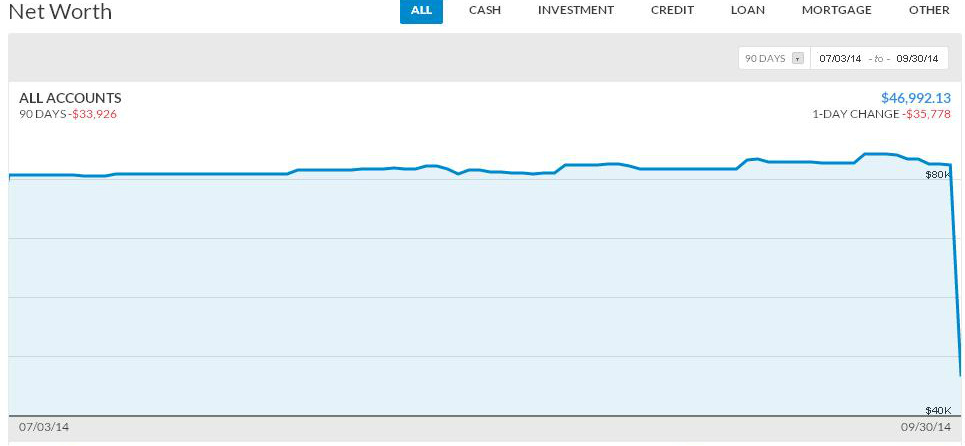

Net Worth:

I use Personal Capital to track my net worth as well as how my (few) investments with Betterment.com

are doing. Right now my focus is paying off debt as opposed to saving, but tracking the positive (net worth) as opposed to the negative (debt) really helps me stay motivated! According to Personal Capital

our Net Worth is sitting right at $46,992.13! That doesn’t seem very high, but remember, I’m only 23. I have 17 more years before 40, when I want to be able to retire. This means I have about $600,000 more to go until retirement!

*Personal Capital is the best, free, online investment advisor and financial tracker. You can check out Personal Capital here!

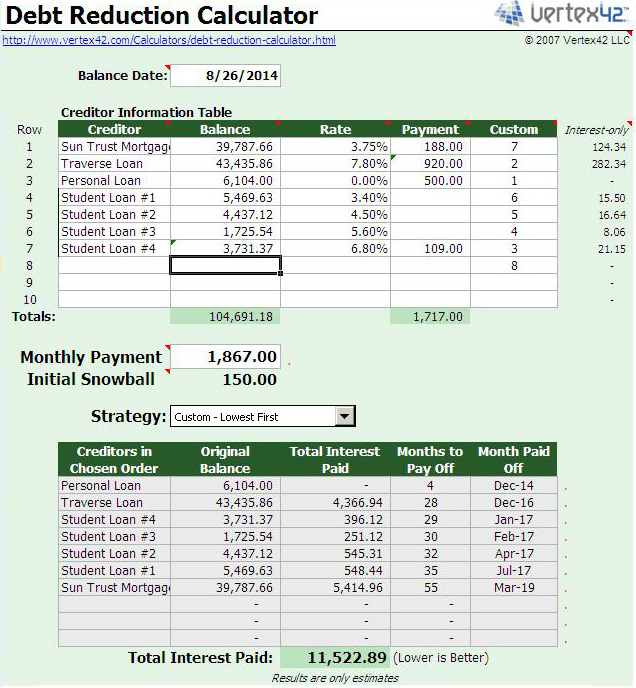

Debt Freedom-

I use a free debt paydown tracker from Vertex42 Templates to track when our Debt Free Date will be. In the top section, I enter every debt, along with interest rate, amount, payment amount, and the order in which I want to pay them down.

In the bottom section it shows me how many month to pay it off and how much interest I will pay in total. I played around with the order or debts to pay until I found the way (I think) I want to pay them off. More to come on October 15th, on that topic.

You can’t see it because it’s on the second page, but the spreadsheet gives us the amortization table for each loan, along with our debt-free date, which right now is February 2017, so we are just under 3 years away. (Except the mortgage. We plan to rent our old house out within the next 4 years, so I’m not in a hurry to pay off the mortgage) Hard to believe with more than $100,000 of debt, isn’t it? That doesn’t even account for the promotion I will (hopefully) get soon, so even though watching my net worth go down can be super depressing, this debt payoff calculator helps to keep things in perspective for me!

Our debt repayment is humming right along! Now, if only we could stick to our budget!

So, what do you think? Retiring by 40 sounds aggressive, I know, but if you would like more information about how I plan to make it happen, check out How much Money to Retire by 40?

*This post may contain affiliate links

Leave a Reply