You’re working, as we are, towards retirement.

Think about it –

- Cutting Costs

- DIY-ing

- Utilizing Credit Card Rewards

- Diversifying Your Income

- Investing

- Paying Off Debt

All of these things tend to take on a life of their own – like our #30k2015 challenge – and seem to overshadow the bigger goal:

Accumulating Wealth

We’re accumulating wealth for the purpose of retiring early, but others’ goals may be different. Others may wish to save for a normal retirement, save for financial security, or simply because they like the power of a strong bank account.

Regardless, if you’re here, you’re working towards retirement in some way, shape, or form.

Which is why I take it up on myself to bring to your attention tools to help you reach your goals (a complete list of which can be found here, BTW).

But today, I want to talk investment fees.

Specifically, how much investment fees are costing you?

Nearly all investments come with fees – especially if you use a big brokereage firm such as:

- Ameriprise

- TD Ameritrade

- Charles Schwab

- E*Trade

- Fidelity

- Merrill Lynch

- Morgan Stanley

- Scottrade

- UBS

- USAA

- Wells Fargo

It’s understandable, really, because these firms are businesses, not charities, and the way that they stay in business is by charging fees for their services. The part I have a problem with, and that I want you to be aware of, is the sneaky ways in which those fees are hidden from you.

Mutual funds often embed the fees within the fund itself, making it hard to determine the different between potential returns and “their cut.”

Personal Capital used data from its 800,000+ users to determine the fees paid by clients of these 11 large brokerage firms to determine:

- Actual Savings Lost Over a Lifetime

- Hidden Fees

- Advisory Fees

- & How Those Fees Affect Retirement Savings

The firms above are listed in the order of most fees charged, to least fees charged, so keep that in mind when choosing your brokerage firm. It is important to remember that Personal Capital is a completely free investment analysis tool that allows you to:

See Your Net Worth:

You have the ability to links all of your accounts to your Personal Capital Dashboard to get a complete picture of your finances.

Analyze Your Portfolio:

Personal Capital’s free tools, Fee Analyzer, and Investment Checkup, assess the health of all of your investment accounts.

Plan For the Future:

Personal Capital’s newest free tool, Retirement Planner, helps you to build a customized retirement plan that you can carry out on your own or bring to a meeting with your advisor to make your financial dreams reality.

Personal Capital’s Investment Fees Findings

First up, Advisory Fees.

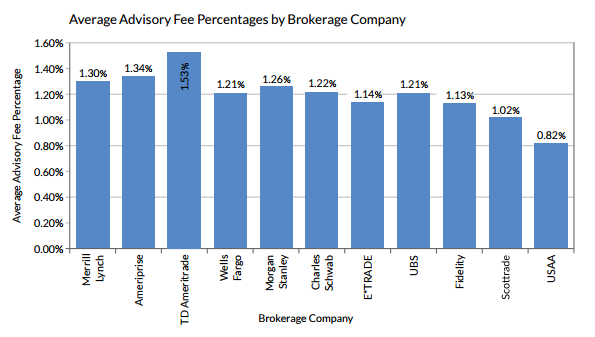

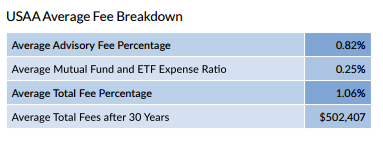

Personal Capital calculated advisory fees by dividing the total annual advisory fees by the total account balance – a fairly straightforward calculation. The findings, which are seen below, found that advisory fees ranged from 0.82% to 1.53%.

Next, Mutual Fund and ETF Fees

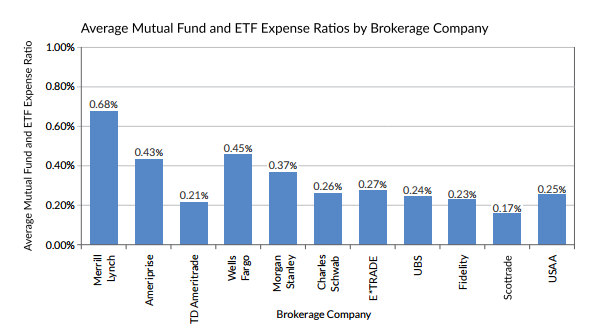

Each financial institution’s mutual fund and ETF fees were calculated by dividing the total fees per account by the total account balance. Merrill Lynch came in the highest at 0.68%, and Scottrade was lowest with 0.17% in fees, as seen in the chart:

Finally, Total Fees

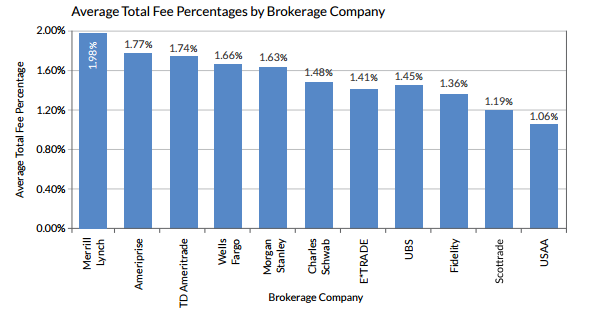

The total fees for each brokerage firm were calculated by adding the Mutual Fund and ETF Fee percentage to the advisory fee. Personal Capital found that USAA charged the fewest total fees, at 1.06%, and Merrill Lynch charged the most in fees, charging 1.98%.

How Many Years Are Investment Fees Costing You?

All of this information is great, but what do all of these investment fee percentages really mean?

I find that the best way to put these in terms which impact me the most is to look at them first in terms of dollars, and then in terms of years they are adding to my working years. No one wants to give away more money than they have to, and they certainly don’t want to work well after their desired retirement age, so this is important.

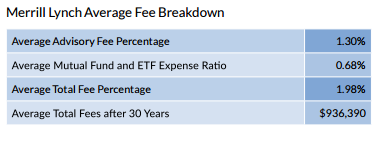

Merrill Lynch

Since Merrill Lynch scored highest for total investment fees, we’ll look at exactly how much money those percentage could cost you. In this example, we’ll assume 30 years with a $500,000 portfolio.

Those Fees Could Cost You $936,390

How many extra years would you have to work to cover almost $1,000,000 in fees? How many more years working in an office, aging past retirement? How many years of not being able to spend time with your grand kids? How many years of working past when your body is healthy?

USAA

USAA’s total fee percentage was determined to be 1.06%, 0.93% lower than that of Merrill Lynch, which we saw above. Using the same example, of 30 years with a portfolio of $500,000, let’s look at how much those fees could cost you.

Those Fees Could Cost You $502,407

The fees from USAA are about half that of Merrill Lynch, but still not an insignificant amount. For myself, these numbers are staggering – both of them – because $500,000 in fees is almost as much as we need to retire – and $1,000,000 is far more than we will ever need to retire.

What You Can Do About High Investment Fees

I understand that my early retirement goals probably differ from many American’s goals, and that’s completely ok.

My retirement number of $650,000 is also probably far these than most people will need to retire, but that’s because our situation different – and that’s ok too.

The bottom line is that you cannot combat high investment fees with a solid plan in place, with eyes open to exactly what fees are costing you, and with a few tools and tricks. If you are with one of these large brokers and fees are costing you years from your retirement, here’s what to do:

Use Personal Capital’s Retirement Planner

This free tool is a great place to start. Not only does it allow you to customize recommendations to your life and financial situation, it gives you an amount you need to save for retirement in order to maintain (or increase ) your lifestyle, and concrete action steps to take to get you there. Sign up for free here.

Look Into Your Fees

If you use one of the 11 brokerage firms I listed in the beginning, Personal Capital’s Whitepaper will have detailed information on the fees you are being charged. Alternatively, Personal Capital’s free Fee Analyze will hunt down hidden and obscured fees in all of your linked accounts. Then, you can choose to either view those fees by account, or as a whole. You might be shocked by how much fees are costing you!

Take Action

If investment fees are costing you a fortune, there are things you can do! Personal Capital’s own investment account charge only 0.99% in total fees, and charge absolutely no opening, service, maintenance, or trade fees – all run by a company trusted by more than 850,000 people. Choosing Personal Capital could not only save you $30,000 – $530,000 in fees over 30 years, it could give you the tools you need to feel confident about your investments, and your future.

What Are You Doing To Avoid Costly Investment Fees?

*This post may contain affiliate links

It’s amazing how high investment fees can be. I like how you looked at it in the number of years it costs. That’s a fun (and scary!) way to look at it. We use a self-directed online brokerage here in Canada (Questrade) – it works well for us because my husband is super interested in investing and loves to do it. I handle the budgets which I like to do so it works out!

A very important topic that doesn’t get enough attention. It’s similar to the topic of inflation. Fees, no matter how small eat away at your total return big time over the long haul. Just like inflation decreases your purchasing power bit by bit. Sometimes these decreases are too small to notice but over time will rob you of a greater return from any investment you make. I buy dividend stocks and make sure each purchase is around 0.25% in commission. It’s something to be aware of all the time. Thanks for sharing.

Totally true! I think a lot of people see those “small” fees and think they’re nothing – and those dividend stock purchases are a great idea!