**Hi there! Like what I have to say? Follow me on Pinterest for more!

I love structure. That is probably why I am an accountant. Because of this, I consistently set goals for myself at work, at home, and for this blog. I have never really posted about them, but as I have some goals I would like to hit and need a little push I thought I would share them with you!

Blog: In April, I really want to focus on social media and SEO. Those are areas where I am lacking :-( and have lot to learn! If you haven’t yet, follow me on these social media sites!

Increase Twitter Followers x100

Increase Pinterest Followers x100

Increase Google + followers x50

Increase Tumblr followers x50

Work on SEO – still learning, but any progress is good progress

Finances:

Pay $500 towards personal loan

Complete 2 mystery shops

Complete 1 survey per day

Health/Family

Workout 2x per week

Lose 2lbs.

Do a date night with The Big Guy

Budget Update –

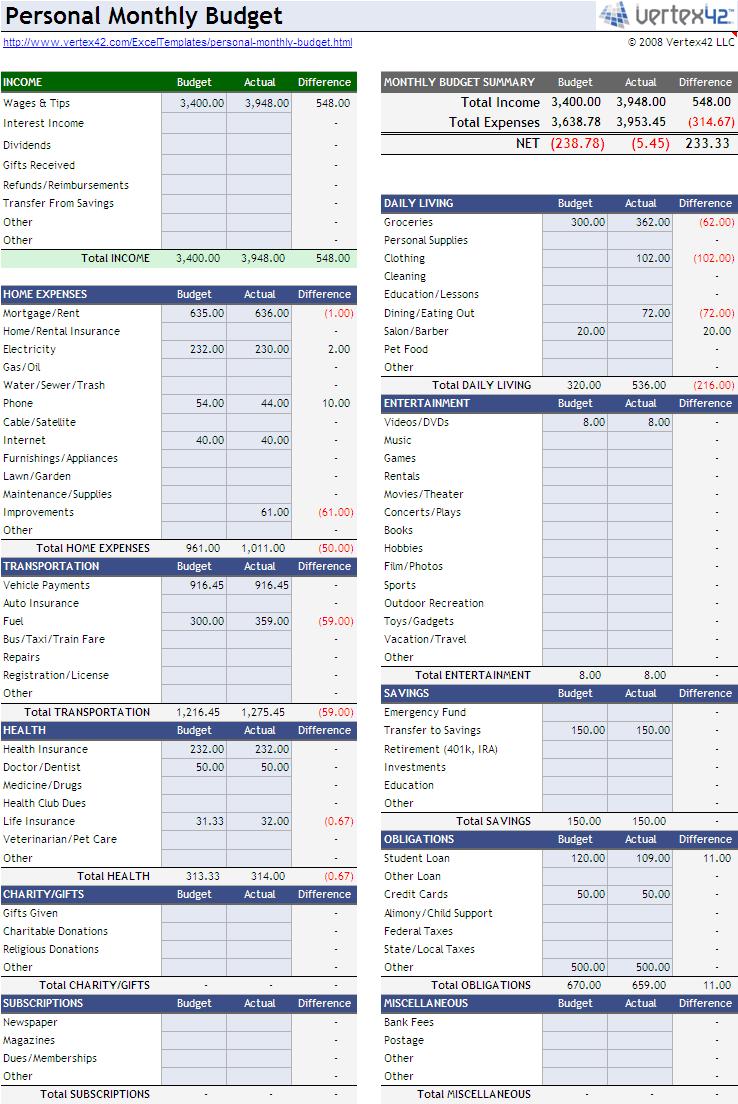

On the 21st of March, I realized that my March 28th paycheck wouldn’t be enough to cover the bills we needed to pay before the next paycheck. When I pay bills on payday, I pay as many as possibly and then look ahead to the next paycheck to make sure we are good there too. Some would say we are living paycheck-to-paycheck, and that is true because I run our checking account pretty close to $0 most of the time. I have found that if we have money sitting in it, we spend it, so anything extra gets moved to savings. I could pull out of savings, right? Yes, I could, but I wanted to see if we could come up with the extra money instead.

On the 21st of March, I realized that my March 28th paycheck wouldn’t be enough to cover the bills we needed to pay before the next paycheck. When I pay bills on payday, I pay as many as possibly and then look ahead to the next paycheck to make sure we are good there too. Some would say we are living paycheck-to-paycheck, and that is true because I run our checking account pretty close to $0 most of the time. I have found that if we have money sitting in it, we spend it, so anything extra gets moved to savings. I could pull out of savings, right? Yes, I could, but I wanted to see if we could come up with the extra money instead.

So, on the 21st, I had to sit down with the Big Guy and figure out what we were going to do about the $250 we were going to be short. First, we had some money coming (about $50) from his dad for some work he did on a rental property, so I emailed him to see if we could get that sooner rather than later. Second, I got myself in gear and finished filing the Illinois tax return, so possibly the $300 we are owed will be here before all of the bills come due. Third, since the tax money coming in is not a sure thing, the Big Guy is going to work for his dad a few nights this week on a house that needs cleaned from construction so it can be sold. Easy work, easy money, and while he does that I get to spend some quality time with Baby RB40. 3 nights during the week and a few hours on the weekend could very quickly net the extra $200 we needed.

Also, April’s Budget looks remarkably similar to March’s. Seriously, its exactly the same….

Wins –

- We had $548 more in income than anticipated. We totally blew our extra income goal out of the water!

- Phone: We switched the Big Guy’s plan with Republic Wireless down to the $10 per month Unlimited Texting and Calling from the $25 per month that included 3Gdata which, after taxes netted us an extra $10!

- Clothing: We spend $102 on clothing, which looks like a loss because I didn’t budget for it, but we bought clearance baby shoes with some of the extra money we earned. Do you know how expensive baby shoes are? Really freaking expensive and they go through them like candy. I now have 6 different sized pairs stashed in her closet ready to go!

Losses –

- Fuel: a so-so loss. We took a trip up north to visit my family, but I didn’t expect to take it, so I didn’t budget for it. We also didn’t budget for…

- Eating out: Unfortunately, do to the unexpected nature of the trip, we ate out quite a bit. So sad :-(

- Groceries were over as well, but each month our grocery cost gets to be less and less, so I happy with this number.

Family/Life Update –

The Big Guy is loving staying home with baby girl! When he first quit his job after I got a promotion (and raise), I was concerned about how well he would do with it. Now, I am totally confident in his abilities! No, my house is not always perfectly clean, and dinner isn’t always on the table when I get home (sometimes its not even started), but baby girls is happy, and so is the Big Guy!

Speaking of baby Girl, she is rolling like crazy!. She started rolling just a little bit at 3.5 months, but within the last month she has become really interested in rolling to get to a toy across the room, the curtains, or an outlet…lol. We’ve have had to do some hard-core babyproofing around the RB40 household!

Baby Girl is also eating her fruits, veggies, and even some chicken and turkey off of a spoon like a champ! It was a rough couple of weeks when we introduced baby food, but now she has the hang of it and LOVES mealtimes! I have made all of her baby food in my food processor, which was something I had committed to from the beginning, but was super scared of how hard it would be. Come to find out, it is ridiculously easy, and I actually really enjoy it. Post to come on the money and health saving benefits of making your own baby food!

Carnival Inclusions-

Aspiring Blogger Personal Finance Carnival # 33 – 14 Ways to Save On Utilities – When You Can’t Turn Down the Heat! & I Need Some Advice – How Much Are You Willing To Spend on your Pets?

PF Carney Lifestyle Carnival – Aldi vs. Sam’s – Is my Warehouse Club Membership Worth It?

Your PF Pro Carnival of Retirement – Aldi vs. Sam’s – Is my Warehouse Club Membership Worth It?

Personal Finance Utopia’s Yakezie Carnival – Spring is Sprung Edition – Aldi vs Sam’s – Is My Warehouse Club Membership Worth It?

Finance with Reason’s Carnival of Financial Planning – Aldi vs. Sam’s – Is My Warehouse Club Membership Worth It?

Master the Art of Saving’s Lifestyle Carnival – How Much Are you Willing to spend on Your pets?

Finance With Reason’s Financial Carnival for Young Adults – Aldi vs. Sam’s Is My Warehouse Club Membership Worth It?

20 Something Bloggers Weekly Roundup – 14 Ways to SAve on Utilties When you can’t turn down the heat!

Personal Finance Utopia’s Yakezie Carnival – Spring is Sprung Edition: Aldi vs. Sam’s – Is My Warehouse Club Membership Worth It?

Save and Conquer’s Carnival of Financial Camaraderie – Aldi vs. Sam’s – Is my Warehouse Club Worth it?

Debt Free Tejana’s Travel Edition: Financial Carnival for Young Adults – My 7 Worst Financial Mistakes & FREE Weekend Closet Makeover

Aspiring Blogger’s Carnival of Financial Camaraderie – Aldi vs. Sam’s

Finance With Reason’s Carnival of Financial Camaraderie – 10 Free St. Louis Family Activities

Thank you so much to everyone who included me in carnivals this month!

It’s Great to have attainable goals. When you go on vacation you have to prepare for how you will eat, its a big budget buster if you don’t. How about Facebook for social media? Do you feel that it doesn’t provide value for the blog?

So true about vacations being a budget buster! It’s amazing how quickly it adds up, isn’t it.

I’m not going to lie, while Facebook has tons of users and the potential to reach millions, I think it is on its way out. Less and less people are actively using it, so I have chosen to focus on other up and coming social media sites :-)