Whew – it’s been quite a while since I’ve done one of these Budget Updates!

When I first started blogging (3 years ago!) Budget Updates were something I did really consistently, for a couple of reasons:

- Accountability: The whole foundation of this website is accountability. I started it to hold myself accountable while paying off debt, saving, and ultimately retiring early, but over time it evolved into a place to share resources that can help anyone save money, make money, or live better with what they already have. That means leaving budget updates by the wayside for a while, but I feel like now is the right time to start them up again. (see the next two points)

- They Lay The Foundation: Budgeting is the foundation of everything I do. When I’m saving money, it’s to find some more wiggle room in the budget. When I’m making money, it’s to supplement our savings goals or pay off extra debt. And in everything, I try to make do with what I have to further my contentment with what I already have – no striving for the newest/best thing.

- Inspiration: I’m not perfect, but I believe that inspiration can be found in the oddest of places. Case in point: my imperfections. Everyone makes mistakes, but it’s how you bounce back from those mistakes that determines whether you’ll “make it’ in the long run. And that’s what I’m trying to show you here.

Now, we didn’t stop budgeting just because the budget updates stopped.

We, like you, have just been unbelievably BUSY. Life is good – great, even – but sometimes you need to step away from broadcasting every single little thing and focus on actually doing. Read: clipping coupons, finding frugal family fun, and taking some crazy amazing vacations.

So with that in mind, I’m going to do my best to bring back the Budget Updates. Each month, I’ll give you an update on how well we stuck to our budget last month, what we’re doing with the mistakes (or successes!) and next month’s projected budget.

I’ll walk you through how we set our budget, some things we’re challenging our family to do in the month, and do my best to be completely honest about the challenges we’re facing. By the same token, I’ll share our victories with you, so you can celebrate with us!

Before you take a look at July’s Projected Budget + Actual Spending, there are a few things you should know:

We Earn Income From Many Sources: Our normal paychecks, rental income (coming soon!) blogging, and a bit of military income from the National Guard. This makes for some crazy fluctuations in income. More on that in the Budget Detail.

We Were In The Process of Buying A Home in July: As a result, we didn’t use a zero-sum budget in July. Instead, we were leaving quite a bit of money in our checking account to cover closing costs, which we didn’t end up needing. Go figure.

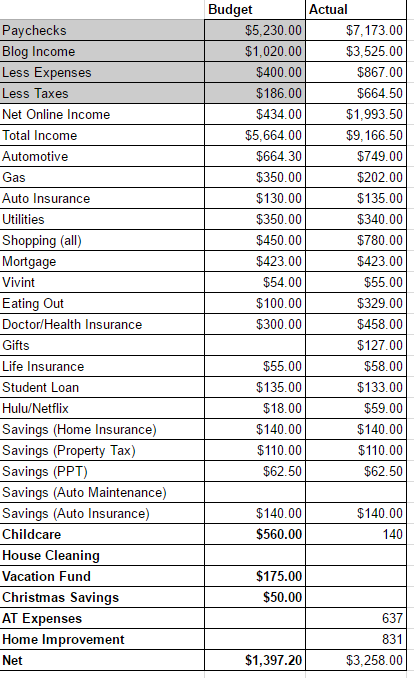

Before I go into more detail, check out our Budget for July:

Now, let’s talk about the crazy fluctuations!

Paychecks: A record month for paycheck income, because when the hubs goes to his 2 weeks of training with the National Guard, he gets a double paycheck: one from the National Guard + his regular work paycheck. It’s definitely a nice perk!

Online Income: Always varies, but this month definitely made me happy!

Automotive: Unfortunately, we do still have a car payment. The principle of paying it stinks, but the interest rate is so low, we’re more interested in saving than paying it off. Also, we had to do some repair on the hubs’ car this month. Unexpected, but not all that expensive.

Gas: A definite win here, but don’t expect it to continue in the coming months. The decrease was due to the hubs being out of town for 2 weeks, and also when he’s gone I’m a hermit a literally don’t go anywhere. Ever.

Shopping, AT Expenses, Home Improvement: A couple of things going here that were completely unexpected, but I honestly didn’t know how much to budget for them. First of all, the hubs always spends an obscene amount of money while at ILARNG training. It’s just life, and I deal with it because he gets a double paycheck. So, the things I could absolutely classify as his went under AT Training. Shopping includes groceries, household stuff, and everything else. Since we were in the process of purchasing a home I also bought some stuff for the new house. (I bought a Roomba, and it’s the best purchase I’ve made in a long time!) Finally, we have home improvement expenses because our old house is going up for rent. This has been the plan since we purchased the home 3 years ago, so it’s nice to see the plan come together :-)

Eating Out: We were just busy this month. Going to take steps to reduce this in August.

Doctor/Health Insurance: I’ve said it before, and I’ll say it again: we NEVER scrimp on healthcare. If we go over the budget, so be it. I make no apologies for spending on healthcare.

Gifts: Found some awesome stuff on clearance, so I purchased it to put in the gift closet. Will be transferring money from our Christmas account to cover it in August.

Hulu/Netflix: You would think that this wouldn’t vary too much, but this includes a few rented/bought movies from Amazon while the hubs was out of town. Unfortunately, when he’s not home, I tend to have quite a bit of insomnia….

Childcare: Was crazy cheap in July. I couldn’t even begin to explain why if I tried, so it is what it is. Normal costs will resume in August.

As you can see, our budget varies. A lot.

And as a veteran budgeter, I can tell you that even if you don’t have side-hustle income, this is totally normal. Life is unpredictable, and your budget has to be able to accommodate that. If you’re just beginning to budget or need some help making your budget work for you, check out these articles that can help you no matter whether you’re at in your budgeting journey:

- How To Determine When Your Budget Needs An Overhaul

- 33 Ways To Save Money, Make Money & Save Your Budget!

- The Importance Of Budgeting for Fun Money

- 3 Things Our Budget Failure Taught Us

- My Favorite Budgeting Tools

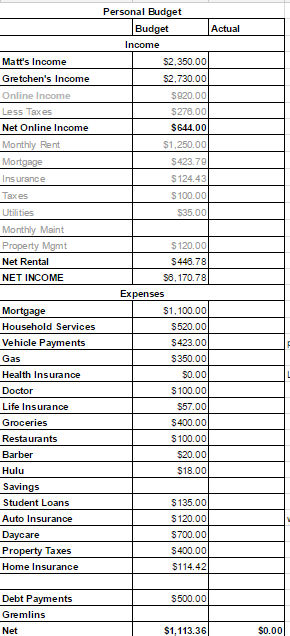

Finally, just for kicks and giggles, lets look at our projected August budget:

We will have another crazy month ahead of us, and as our income sources diversify even more I’ve been revamping what our budget spreadsheet looks like to make it easier to understand, read, and plug number into.

I do still use Personal Capital to track our income, expenses, and net worth, but then to make it easier to boil down at the end of the month I plug numbers into a simple spreadsheet for the blog and for the hubs and I to review. You can find out why I use Personal Capital here, or check them out for yourself.

Tell me, how did your budget do in July?

This post may contain affiliate links. See my disclosures for more information.

Our budget for July was well…not so good. We struggled with buying and visiting/celebrating 3 birthdays in the same month. We were less than prepared for them and ended up overspending a little. We didn’t totally blow our budget, and we made some efforts to earn a little extra cash to help out (this made a big difference) but our budget didn’t look so great :/.