During my 1st Year Blogiversary post, I asked you all if you would be interested in my doing both a Pinterest post (since 60% or more of my traffic comes from Pinterest) as well as an income report now that I am actually making some money! Your response was overwhelmingly "Yes!" so I'm going to … [Read more...]

Money Talk: Should you Build Your Child’s Credit Score?

I should have titled this, How to Set Your Child Up For Financial Success (or Failure).....adding your child to your credit card while they're young can have either a overwhelmingly positive influence on the rest of his life, or devastatingly negative influence. Legally, it's a gray area, so why … [Read more...]

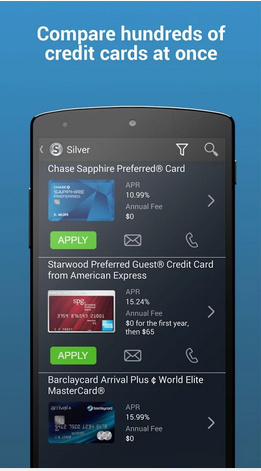

Maximize 2015 With the Perfect Credit Card – A Silver Review

Good Morning! I'm still reeling in shock that it's 2015! If you missed my 2014 recap, let me sum it up for you: we paid off our personal loan and credit cards, and then had some big unexpected expenses come up and put them right back on those credit cards. But are we going to stop using credit … [Read more...]

Free 2015 Blog Tracker Download + 2014 & 2015 Blog Income and Goals

Welcome to my cliche year in review! I already did one for our finances, so now it's time for the blog! Earlier this year, I committed to complete transparency with regards to how much money this 'lil site of mine earns, as well as how I'm earning it. This transparency has been given in the form … [Read more...]

Our 2015 Goals

Now that our personal loan is paid off (!) and we took December off from super stringent budgeting, and even debt payoff over and above the minimums, we’re gearing up to hit debt hard for the new year! Here are our 2015 goals: Finances We’ve had so many changes - in income and expenses, … [Read more...]

When Something’s Gotta Give (A Living Well Spending Less Review)

As a blogger, mom, and woman with a full-time career, I find it extremely hard to balance the demands of everyday living. Each morning, I’m up before the rest of my family is (and wont be for another 3-4 hours). I’m at work by 6am each morning, and then home at 4:30pm. Once I get home in … [Read more...]

4 Ways to Combat Social Media Spending

I am a woman, therefore I am maybe a bit more obsessed with Pinterest than I should be. Not every woman is like me, but I would venture to guess that 90% of women love getting information, how-to's, and recipes from Pinterest - and more and more men are getting involved in Pinterest too!Did you … [Read more...]

Lower Your Phone Bill – By $2,100 a Year!

I remember when I was in college. I have no desire to go back, believe me, because aside from the being broke all the time and waiting tables, I got married my freshman year, and soon thereafter I adopted some of my husband’s spending habits. He’s a great guy, but he's the spending and I’m the … [Read more...]

How I Never Pay For Oil Changes

Auto Maintenance tends to sneak up on me. Sometimes, we need one every month, sometimes every other month, and sometimes we don't need one for 3 months. I try so hard to figure out our mileage, and if we have an oil change coming up, so I can factor it into our budget, but it never works.Yep, … [Read more...]

Money Talk – Does Money Control You?

Every day, it seems, my life revolves around money. At work, I tell money where to go, determine what the money did, and decide where the money is going.Then I get home and look at what money came in, where we need to spend money, and find ways to save more of it.Focusing on money isn’t a … [Read more...]